Okay, I know I said I would not be writing a blog until I was back from vacation but I lied. I have one more short blog left in me that I need to get off my chest. And it involves some predictions on what may or may not happen while I am away and maybe some prognostications about the state of the world. We live in times that are far too interesting. In many ways, I wish it was a little more boring. Remember Stephen Harper? Barack Obama? BORING!!!! I miss those days. […]

Stampede Again, like I did last summer

I know I said I was going to reduce the blog to once every two weeks during the summer and rest assured, I plan on doing that, but for now I am still going strong. Expect that next week you won’t hear from me, and maybe not the week after. Or the week after that. Why you ask? Well, yours truly is taking his family on a much-needed extended vacation. And I won’t be allowed to write. More than likely. Here’s hoping it can at least be relaxing. I say that because the last […]

Oh. My. God.

Oh. My. God. Yes. Oh. My. God. This of course is the timeless declaration of the inestimable Jonathan Higgins when presented, yet again, with some crazy transgression by none other than my favourite character in my favourite television series – Magnum PI, in, umm, Magnum PI. Not the new reboot, no, the classic 1980s version – that ran just a few short years after Joe Biden was first elected to government. I am reminded of Higgy’s outburst because we are half-way through the year and it is report card time for my Fearless […]

Happy Bidet Canada

Today is one of those glorious historical anomalies for the Crude Observations blog that some people might call a coincidence but that I consider to be a Gregorian twist of fate. As wen enter the summer months, I have many traditions for the blog including the birthday blog, the review of my terrible forecast blog, the Canada Day blog and the Stampede blog. Then it’s the vacation blog. If I feel like it. It is rare for the blog to fall on the actual day for one of these traditions yet this year, it […]

59 Bottles

Well folks, here it is. That time of year where we all hopefully are starting to wind down. Kids are coming out of school, people are getting excited for their upcoming vacations, assuming that they have an up to date passport and all of Calgary is preparing for Stampede in their own unique way. Whether that is dusting off the cowboy costumes for another year of fun or high-tailing it out of town doesn’t really matter – I’m all about tradition. Another tradition this time of year is the ritual bloodletting for people foolish […]

Pre Mid Year Blues

June 14th already? What happened? It feels like just yesterday it was June 13th. And the day before was January 1st. As most of you know by now, the mid-June blog is mostly a random walk as I am in full battery recharging mode getting ready for the rapid fire series of blogs that is going to be the traditional Canada Day celebration of canuckleness, my mid-year forecast rehash, the Stampede celebration and then, sweet merciful crap, I leave on vacation for multiple weeks when the only thing that will cause me to publish will […]

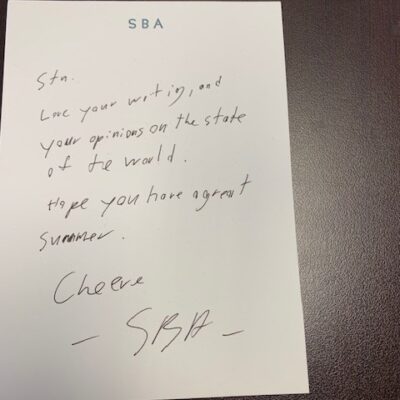

80 and 5 will let you down

I know this is supposed to be a week off, but I am compelled to post something. A year ago this week, my personal and business Twitter universe was rocked by the passing of someone who was, for me, an online friend but for others in this online universe I inhabit a true friend and beloved family member. So, to honour and remember this individual, I am re-running the blog I wrote at the time about him, the weirdness of the online world and the changing nature of friendship. SBA (@SadBillAckman) was an anonymous […]

Unforgiven

Apologies to everyone who was expecting a blog last week, but things have been busy in both my personal and business world and when last Friday rolled around I realized that what I really needed was a break, so I took advantage of a short and slow week to avoid any kind of writing whatsoever except the tow Confidential Information Memorandums I had to complete. Such was my commitment to NOT doing a blog that I instructed my partner to come into my office and confiscate my laptop if he heard even a hint of […]

May 24

I am reupping this annual missive to the Canadian May Long weekend for several reasons. One – I am tired and need to be a reposter for a bit but I know you all like this annual reminder. Two – I am nowhere near the office. If you must know, I am in the thriving metropolis of Beaver Utah, a place my business partner was at no less than a week ago. Word to the wise – do what I did – the EAST side of the highway is way better. Third, I am a […]

What Do You Want?

There’s a joke in our house that revolves around that statement. It comes from my mom. It happened about 12 years ago. I called her on either her birthday or Mother’s Day – pretty sure it was Mother’s Day. Of all things. The nerve, right? I can’t remember who it was who answered – my dad or her. All I know is when she got on the line and heard my voice that’s what she said. A comment that will live in infamy. What did I want? Well, to say happy mother’s day for one. […]

Expanding

Is it finally May? It’s hard to tell, given that Calgary got slammed by a typical May Day storm and my deck and yard and car was covered by close to 15 cm of the wettest, heaviest snow I have shoveled in what feels like 100 years. ‘Cause you know I was shoveling 100 years ago. Shoveling something. At any rate, the sun is coming out finally so it looks like something resembling spring is on the way, notwithstanding the temptation I have to go skiing next week, just because. You know what […]

Draft Day 2024

Well after last week’s liberating vent on the new federal government proposed tax hike on capital gains, I thought for sure I wouldn’t have anything to wriote about. And you would be right. But fortunately, I am creature of habit, and that habit means I sit down every week and if words start to flow, I will have a blog. And if they don’t start to flow? Well then it’s typically a shorter blog. Fortunately for me (and you), after close to 9 years of hammering the same keyboard to come up with original […]

Capital

I was actually going to take a wee break from my blog this week after last week’s epic meltdown about my thoroughly inadequate first quarter report card on my Fearless Forecast and I was doing a good job about not stewing and tormenting myself about the world at large, the people in it who purport to control our lives or the monolithic governing institutions who wreck everything just because. And then wouldn’t you know it? As they are wont to do, along came the Trudeau(p) LPC minority government with a big swinging debt-ridden, subsidy […]

A Q1 Debacle

Has it been an entire quarter so far? It feels so much longer, doesn’t it? But no, it’s been just one quarter, which means we are 25% of the way through the year and it is time for me at Stormont central to stand up and face the music, pay the piper and have my day of reckoning. Why is that the uninitiated might ask? Well let me enlighten you. You see every year I write this thing called the “Fearless Forecast” which is the compilation of my wisdom and prognostications for the year. […]

Bracket this

Ah, NCAA March Madness. How I have missed you. It is hard to believe it has been a full year since I have been able to sit down and listen to the sweet and somewhat jarring sound of squeaky shoes on a gym floor as my favourite sporting event unfolds in front of me on office TVs, secretive channel switching at home and late-night PVR’d buzzer beaters. I know we are already mid Sweet 16 and all the brackets are busted, even mine, but this tournament has been pretty exciting with many Cinderella stories. […]

When Ides of March are Smiling

Happy Ides of March everyone! Or is it Saint Patrick’s Day? Or is it some weird mashup of both. It’s a weird convolution of all these days into one glorious green-festooned ritual stabbing in the back of and drinking of Caesars and other cocktails made famous by betrayal and the shepherding of snakes off an inhospitable island. To honour the days in question and to be effective with my time, I am going to go out on a limb with a not very well thought out listicle of the 10 individuals of renown who […]

And The Winner Is

It’s March 8th and I’ve got nothing to say. Next week is my annual Ides of March issue, wherein I will let you know which public (and not so public) figures may or may not find themselves stabbed in the back so I need to keep a lot of my arrows in the proverbial quiver, as they say. On the other hand, I have committed to the long/short bi-weekly missive so content must of course be produced. First off, let me say that last week’s blog about Alberta’s new (and lamentable) renewables policies and […]

Leap!

Welcome dear readers to what is my favourite day of the year – February 30th, the day after Leap Day which as we all know is the greatest holiday of them all, what with the appearance of Leap Day William and the efforts to avoid the coming of March since as we all know “Real life is for March!”. And in the spirit of that day, I’m going to something I only do every four years, publish a stream of consciousness rant, mainly because I can. But before I do that, I just want […]

Taking Flight

So last week, I didn’t write a blog. I am hoping that someone at least noticed that because I do put a lot of effort into the blog and I like to get the pat on the back and the “atta boys” I occasionally receive. There was of course a particular reason I didn’t compose a blog and I will get into it in a bit, because it is typical for how we live our lives. But let me first say that February blogs are the hardest. It’s the shoulder season for blogging – […]

Super Duper

It’s the most wonderful time, of the year! It is, isn’t it? That’s right, Super Bowl Sunday! The day of days. The culmination of all the hard work I have done since September. Forcing myself seemingly day after day to watch football games, read football news, talk about football, PVR football and bet on football. And let me tell you, I am a master of all of these. Except the betting part. That really didn’t go as planned. Fortunately, all I lost was a couple of Bitcoins and some NVIDIA stock, so I’m all […]

Early Spring?

Time for the annual Groundhog Day post. And for once, I am doing it on the actual day of groundhogging. In fact, by the time I push send on the old Mailchimp interface, all of the hogs from the ground across all of North America will have opined on whether we will get an early spring or suffer in winter’s dark and frozen hell into eternity. And as I contemplate Groundhog day, I am, as always, reminded about the many ways the expression “the more things change the more they stay the same” […]

10 not top

So, I guess I am taking a break this week. Still spent from the whole Forecast thing, my Air Canada correspondence (I would note I received a polite and informative reply – nothing is changing but routes are constantly being re-assessed, so I hold out hope), work and, if I’m being honest, a 36 hour jaunt to Toronto to visit the Bata Shoe Museum and eat bacon at a venerable and iconic Toronto greasy spoon. This doesn’t mean that I am not paying attention to what is happening around the world, I most assuredly […]

Post Forecast Let Down

So, the aftermath of the Fearless Forecast blog, which sucks out a lot of energy from yours truly is really akin to a massive hangover. I am devoid of ideas, writing skill, desire – you name it. The random number generator is spent. And yes, I apologize for the worst Super Bowl call in all of forecasting history. I picked the Cowboys because they seemed good and were likely to go far. I never anticipated that a bunch of pro athletes would have that little motivation or competitive fire and get completely whipped in […]

Fear but Less

Well, here we are people. Your favourite time of year. That brief moment in time where I seem like the prescient genius I actually am That shiny little nanosecond where I am on the front of the Titanic, a veritable King of the Forecasting World before it all comes apart in a ritual of self-loathing and abject, public, humiliation. That’s right, it’s the Fearless Forecast! Brought to you by the same hapless scallywag who brought you $90 oil in 2017, bullish investment calls on Canadian rig operators and perpetually optimistic forecasts as to […]

All Done

Thank god that’s over Alrighty then. That’s it. It’s over. Done. Finito. Tripped the light fantastic. Passed into history. Over and out. Gonzo. Never to be seen or spoken of again. That, as they say, is it. And not a moment too soon because in a word, 2023 was awful. And terrible. And in many ways fantastically awesome. This, my first blog of the year, is where I review my Fearless Forecast from last year, take some lumps and celebrate some triumphs. And I will still do that. But first, I need […]

The Night Before

Well here it is, Christmas Eve, the shopping is finally stopping and the family is sitting around being uber-lazy and getting ready for the big day. I know I promised last Friday was the last blog for the year but I can’t help myself. The tradition is a poem on Christmas Eve and gosh darn if I’m not going to honour that and regale you. In 2022 at this time everyone was feeling upbeat and constructive on Canadian energy, but the rest of the world was sweating it out through runaway […]

Not Knotty, Naughty

Hear ye, hear ye. I bring to you, upon this, the 10th day before Christmas, a purloined list of characters both naughty and nice, as well as some ideas for gifts for our favourite characters and influencers from the year just past. And to be fair, there is no shortage, at all, of worthy and unworthy recipients of the Big Guy’s largesse or ironic gifts intended to be lessons for one and all. Upon review of this list, we will be able to decide whether the named individual is to be bequeathed a gift […]

Emissions Capped Movie Night

This week is supposed to be all about my top 10 Christmas movies but I have to take a few minutes to do an aside about the recent government policy announcements regarding emissions in general and the energy sector in particular. For those of you who are living under a rock (or just don’t care) the Canadian Liberal minority government has long teased everyone who would listen about upcoming regulations targeted specifically at the evil oil and gas sector to force it to reduce emissions related to methane and carbon dioxide – both of […]

Calendar COP

Public Service Announcement. Before I get into my annual recycling of holiday blog ideas, I first wanted to say a few words about COP 28. Actually, who am I kidding. Is anyone else as fed up with this annual boondoggle as I am? 70,000 people descending on Dubai, in the United Arab Emirates to finger tent and act oh so pious and concerned about emissions and the environment, hosted by one of the largest oil producers in the world in a city that by all rights shouldn’t even exist because it’s in a freaking desert. […]

Not a Fossil

Sadly for the blogging world, I seem to have run out of time this week to do anything spectacular plus I need to rest up my creative energies so that I can do the sprint to the end of the year in peak condition. You may not know it yet but some of the best material is coming for you including, maybe, an Advent Calendar, a movie ranking, a naughty or nice list and not least a kick-ass Christmas Eve poem. Of course in this calm before the storm I need to find some […]

Stuff I’m Watching

Well hot on the heels of last week’s blog celebrating some of our recent client successes I find myself staring blankly at my monitor wondering what on earth I can write about this week, which is traditionally the last slow week before the chaos of the holiday season is upon us as I navigate in quick succession American Thanksgiving (it’s all about the football to me), a milestone birthday for my lovely wife, a variety of work related holiday gatherings, my dad’s birthday, Christmas and a much needed escape to the desert for New Year’s. […]

Closed

Last week I had the opportunity to regale you all with anecdotes and cautionary tales dealing not only with soul-crushing and immovable bureaucracy but also the idiosyncrasies of deal making and a select few of the many, many roadblocks and deal-breakers you can see along the way. But it doesn’t always have to be that way. In fact, some deals go so smoothly it seems like no effort is required. Or so I’m told. Which brings me to this week where I’m going to spend a little time tooting our horn, which ironically is […]

Breaking

As always, the week after Halloween is a weird time in the Crude Observations world as I try to wrap my head around how I am ever going to prepare for a full on blitz of Christmas blogs (we are mere weeks away from the Advent Calendar and Top Movie list!) while juggling an actual work and family life. Sometimes I like to mix in a bit of travel just for fun – and I did just that this year – in fact I took the red eye after Halloween to Toronto. How much fun […]

Trick Treat Whatever

First off, I apologize for not doing a blog last week. I was off to Vegas to see U2 at the Sphere and it was every bit as awesome and spectacular as you can imagine, if not more so. It was also the first cross-border trip my wife and I have taken where we left our kids at home to their own devices (all Apple) and I have to say it was completely worth it. U2 and Vegas were awesome. The food was great and the company was spectacular and without peer! And, the house […]

Friday Fear

Finally! That’s right, finally. As far as I can tell, this is the first Friday the 13th of the year which means it’s the first time I have done a blog on a Friday the 13th since the last time I did one. Having only one Friday the 13th has to be some kind of statistical anomaly, although I’m sure if I looked, I would be able to find one in the recent past. OK, now I have to look… dang it, I was wrong. There was a Friday the 13th… in January. The day […]

Q3 Report Card

Canadian Thanksgiving already? Where did the time go! I feel like it was just 3 months ago that I was on an airplane going on vacation and writing my forecasting obituary. Q2 was not solid. And I have this gut feeling that Q3 isn’t going to be much better, notwithstanding the scintillating run-up in oil prices that we saw in September (only to give back… in the last few days). But I have to do my review. Even if it’s a long weekend and even if this turkey, to belabour the metaphor just a […]

Lazy Day

Well, here it is, the last blog of Q3. Too early to do my Report Card on the Fearless Forecast and, due to circumstances beyond my control, too late to do something completely original from scratch as my professional, M&A life continues to interfere with my blogging side-hustle. What do I mean by that? Simple really. We have been busy. Really busy. As of Sunday (well 11:59 PM Saturday), we will have closed three significant transactions on behalf of clients since August 11th. This is quite the stretch, especially when you consider that summer […]

Halfsies

Well, this has certainly been an interesting week in good old Canada for what is supposed to be the “short blog”. I mean between the spectre of countries conducting extra-national assassinations in our own backyard, a continued shakedown of Ottawa by Alberta, ongoing Chinese election interference, the Ontario Greenbelt fiasco and the ongoing persistent cost of living crisis, it’s hard to know what to focus on. I mean, I can’t do oil prices because I celebrated that short-lived $90 juggernaut last week. And I won’t do gas prices because… Well we all know why. […]

Happy $90 Oil Day (for all who celebrate)

As an energy industry participant, investor, lover and hater I spend a lot of my time immersed in the minutiae of the energy industry, the oil price, its movements, the price of natural gas and its irrational gyrations and all the factors that push and pull these magnificent commodities in often infuriating and counter-intuitive directions on a daily if not hourly basis. It is not uncommon for my business partner to have to turn off BNN because I am unhingedly yelling at yet another of the procession of talking heads they bring on to […]

Changing of the Guard

True to form I do a Labour Day blog every year and then find myself, as with every early September, inundated with all sorts of nonsense like “client demands” and “kids back in school”. Then I’m stuck, late on a Friday afternoon, typing a blog that I have no sense of where it’s going to go or whether I should even continue. Mainly because I am searching for a topic, but also because the freaking Rugby World Cup is on TV and it’s the opening match featuring New Zealand playing the host French national […]

Stop the Presses!

It’s Labour Day! Ah Labour Day. That annual celebration of the righteousness of the downtrodden worker, the brave collectives, union members putting it all on the line day after day in order to enrich the greedy corporate capitalist fat cats who live for exploiting the masses. And which union am I talking about most specifically here? Why none other than the NFLPA (NFL Players Association) and their hardworking members as they head into what is the 104th season of NFL football. As most of you know, I am a huge NFL fan. […]

Memo Random

Note – as I write this, Canada’s forest fire season from hell continues to rage unabated. We at Stormont have clients, friends and family all affected by the current evacuation and emergency orders in Yellowknife NWT and the Kelowna area. Please consider a donation to the Red Cross to assist those in need across the country. Links for 2 options are below – one directed at NWT efforts, the other a collective “Canada” option. I did both. Together we can make a difference. RED CROSS CANADA – NWT RED CROSS CANADA – WILDFIRE […]

10 (ish) Things

Last year, I took my family on an epic vacation and when I returned, I did a short mail-it-in blog that reflected some thoughts I had on where we had been and how moving around the world outside of our little bubble that is Calgary can offer some pretty cool perspective on the truisms that define our lives. As I said then and will cut and paste now, perspective is everything and sometimes it is worthwhile to take yourself out of your comfort zone and look at things from the other side and you […]

Vacation Report Card

So, this is what it has come to. I am on a plane, going on vacation, and planning to take significant time off doing a blog and I have come to the crushing realization that I forgot to do my Fearless Forecast second quarter review. Okay, maybe I didn’t forget, maybe I just don’t want to face the facts on how bad my year is going. That seems more apropos of how things have been going. I do have tremendous confidence in the third and fourth quarters though so this should be the last […]

Stampede Already?

It’s so lonesome on the saddle since my horse died… I know I said I was going to reduce the blog to once every two weeks during the summer and rest assured, I plan on doing that, but for now I am still going strong. Although I did miss last week, and expect that next week you won’t hear from me, and maybe not the week after. Why you ask? Well, yours truly is taking his family on a much-needed extended vacation. Here’s hoping it can at least be relaxing. I say that […]

Canada D’Eh 23

Today is one of those glorious historical anomalies for the Crude Observations blog that some people might call a coincidence but that I consider to be a Gregorian twist of fate. As wen enter the summer months, I have many traditions for the blog including the birthday blog, the review of my terrible forecast blog, the Canada Day blog and the Stampede blog. Then it’s the vacation blog. If I feel like it. It is rare for the blog to fall on the actual day for one of these traditions yet this year, it […]

58 is Great

Well folks, here it is. That time of year where we all hopefully are starting to wind down. Kids are coming out of school, people are getting excited for their upcoming vacations, assuming that they have an up to date passport and all of Calgary is preparing for Stampede in their own unique way. Whether that is dusting off the cowboy costumes for another year of fun or high-tailing it out of town doesn’t really matter – I’m all about tradition. Another tradition this time of year is the ritual bloodletting for people foolish […]

Saying Goodbye

It has been a rough week here in anonymous blog land as we/I and a collective group of named and anonymous Twitter users and actual people said goodbye to one of my regular readers, critics and promoters of this blog – an anonymous Twitter account whose handle was @SadBillAckman or SBA as we all knew him. Sad Bill was an anonymous “Alt” account that belonged to an actual person named Mark, an Edmonton-based energy sector worker who was also an active Twitter account in all the same spaces as Bill. Mark was young and […]

On The Road

Another shorter blog this week folks as I have just recently returned from a fever dream of a trip inspired by none other than Jack Kerouac’s seminal novel of American Discovery and road tripping – On The Road. And the reason the blog is shorter of course is because I was away so long, I avoided doing any actual work, so I have many emails to return. Oh, and in this glorious retelling, there are no hallucinogenic drugs and other illicit activities. Sorry, this the G-Rated version. To set the scene, I am vehicularly […]

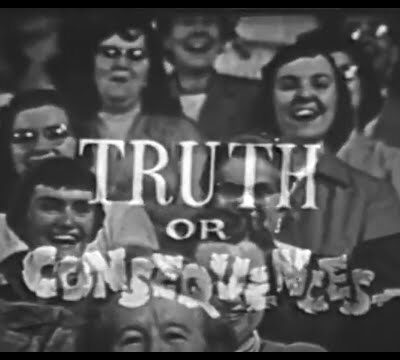

Truth and Consequences

And just like that, it’s over. The Alberta election has come and gone and lo and behold, we have a Danielle Smith led UCP majority, albeit a slightly smaller if not less humble majority. At the latest count the UCP won 49 seats and the NDP 38 making this one of the slimmest majorities in Alberta political history, which is kinda cool if you think about it, even if the UCP supporters are terrified of the commie pinko NDP hordes nipping at their heels and the NDP supporters are crying in their pillows about what […]

Election Direction

This is it. The last blog before the big day. And it’s a long one. A doozy. Many, many words. I know I have been threatening it for some time, but this is the day I have to actually make my prediction in this godforsaken Alberta election. I can’t avoid it anymore So I’m going to do that. Soon. But first, I feel I must veer off topic and tell a wee story. This blog started about eight years ago. Under oddly similar circumstances. You see, at that time, in 2015, Alberta was going […]

May Long Musings

Ah, May Long. The best weekend of the year for us Canadians. Any number of reasons. Primarily it is the first long weekend of the year where we aren’t typically house bound. Secondly, because of history. What history you ask? Well let me edumacate you. We used to call it Victoria Day in honour of the birthday of Queen Victoria who ruled the Commonwealth for what, 250 years prior to Queen Elizabeth the Second and just after the 1500 year reign of Queen Elizabeth the First. I’m sure there was someone else in […]

Mothers Day and Stuff

Happy Mother’s Day to all who celebrate. Which really should be all of us, except of course Frankenstein’s monster who was kind of assembled, but I guess all the parts had maternal origins? Sorry. Good lord, where in the world was I actually going with that? At any rate, happy Mother’s Day and don’t forget to think of all those whose mothers are no longer with us and spouses, siblings and progeny who are themselves mothers. That’s a lot of celebrating to do but in all seriousness, why not? Make it a week, a […]

Bringing the Joy

It’s been four months now since I promised to do a bi-weekly blog and so far my track record… well it kinda sucks. Apparently I am unable to stop writing this thing and sharing my various opinions with all of you. Last week was supposed to be a week off and it wasn’t. I think I missed the week prior. Who knows anymore! This week I am going to try and be more positive than some of my last few week, since a few eeks ago was an “airing of grievances” of sorts. To […]

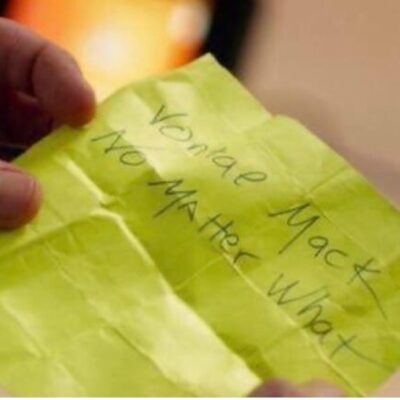

Is there a draft in here?

Vontae Mack. No matter what. Wow. That’s cryptic. Hey, did anyone notice I wasn’t here last week? Because I wasn’t. I hope some of you noticed. I would be awfully sad if you didn’t. I was off tending to some personal business and, whilst cooling my heels in a hotel room far, far away, I decided that I would not publish a blog that day. To be honest, I wrote one. But I put it in my proverbial pocket for another day. And here I find myself yet again contemplating what I should […]

Complaint Department

Looking back through my blog history gives a really interesting perspective on the strange ways the brain works. Well, mine at least. I know I spend a lot of time and effort working on the Fearless ForecastTM that I hope no one ever takes investment advice from… because. Then at specific points during the year, I self-assess thus proving my point about not taking that forecast as investment advice. All these things take time and an emotional investment into the process. This of course leads to the inevitable letdown the following week where I […]

Good Friday Report Card

Happy Friday everyone, I hope it is good no matter which version of a religious observance or long weekend you are currently choosing to practice. We are 100% non-denominational, fully religiously tolerant and even accepting of the fact that the most deeply thoughtful and introspective thing you may do on this whole long weekend celebration of resurrection is watch Tiger Woods try and resurrect his career one wincing in excruciating pain swing after another at this year’s Masters tournament. It is also a Good Friday because today I get to report back to all […]

Foolish Budget

Look, I know I promise every week I am going to make this a bi-weekly thing and I swear I will do it eventually but there was some pretty big news that happened this week that I feel needs some analysis. And this big news and analysis is distracting me from a number of really important things, namely my in depth first quarter review of my Fearless Forecast (head’s up – it ain’t gonna be pretty) and that thing I do in the office… what’s it called…? Oh yeah – work! So what was […]

Sweet!

Ah, NCAA March Madness. How I have missed you. It is hard to believe it has been a full year since I have been able to sit down and listen to the sweet and somewhat jarring sound of squeaky shoes on a gym floor as my favourite sporting event unfolds in front of me on office TVs, secretive channel switching at home and late-night PVR’d buzzer beaters. I know we are already a week into the tournament and all the brackets are busted, even mine, but this tournament has been pretty exciting with many Cinderella […]

And the Award Goes to…

Well, this week I feel it is time to revisit something I wanted to make into a tradition but failed a bit at because I of course got lazy and forgot. That’s right, it is time to acknowledge an event that is universally loved by seemingly everyone I have ever known and, let’s be honest here, everybody else. I’m talking of course about #CERAweek – which is shorthand for the annual springtime convention held by S&P Global that Features a veritable who’s who of government officials, energy sector participants, professional convention goers, wannabes, gonnabes, […]