OK folks, that’s a wrap. The year is over. Finally. And what a year it has been, particularly for the energy sector. And by that I mean it hasn’t been a particularly great year. In fact, I feel it has been a bit of a lousy year. A forgettable year. A dumpster fire of a disaster year. Even with prices staging a super-excited late year rally, the sector is still stuck in the weeds, trying to figure out its way.

Here in Alberta, it’s even worse than elsewhere. For the umpteenth year in a row we struggled with lack of pipeline access and felt helpless as our energy woes were treated as political footballs by multiple layers of elected governments, wannabe governments in waiting and unelectable parties that just hate anything to do with burning a fossil fuel.

Critical pipeline expansions and developments were and are held up in courts in both Canada and the United States for reasons both legitimate and spurious. Curtailment established itself firmly in the political and industry lexicon as production was deliberately held back in Alberta to prop up prices, killing upstream capex while south of the border, production growth continued its indiscriminate, inexorable path forward, tanking prices and, ironically, eventually killing upstream capex. Can no one find a proper balance?

Solutions were proposed and came close to implementation but were shelved when power changed hands in Alberta, so we wait for a crude by rail solution that it appears industry is still unwilling to provide.

Meanwhile in the broader world, we have a new Canadian government. And by new, I mean the same but different. It’s a minority government, with a chastened Liberal government trying to walk the fine line between angry Conservatives with virtual monopoly representation between Thunder Bay and Robson Street, a resurgent separatist party in Quebec and a weakened but still progressive vote drawing NDP. At the same time, an overfly cranky Alberta (five years of lousy economic growth does make one testy after all) finds itself battling through the trials of #wexit, a movement so stupid it may just take hold.

I think if I can sum up Canada in 2019, it would be as follows:

On an international basis we had trade wars, impeachments, climate protests and strikes, #Brexit drama, Middle East conflagrations and shenanigans, right wing/populist power consolidations in places like Turkey and India, ethnic cleansing in China and daily pro-democracy protests in Hong Kong.

Against this backdrop, stock markets soared, social media bickered, Tom Brady aged, economies slowed and the world continued on, blithely unaware it was headed for a proverbial iceberg, which, it now appears (notwithstanding the US trying to start WWIII by assassinating actual terrorist and #2 political figure in Iran Suleimani) will be fully melted prior to impact thanks to global warming.

Like I said, eventful. And how much of this do you think I predicted? Well it’s time to take a look and assign a final grade, because today is the day I review my Fearless Forecast from last year and come clean with everyone that much like you, I really have no idea what is happening in my own backyard, much less around the world.

I would note I am on vacation this week and had promised myself to take a week off the blog, but you know I can’t resist – I miss everyone too much!

At any rate, I will try and keep it short, in respect of that whole vacation thing.

Broad Themes

The forecast for this year started with civil unrest, particularly in the Middle East, which, now that I think about it, while a bit of a cop out was quite prescient. After all, what could be easier than predicting unrest in Iran, Iraq, Israel, Palestine, Yemen and other places, especially with US sanctions biting in Iran, Syria doing that Syria thing, ISIS being defeated, Turkey and Russian meddling. The usual. As a forecast, it’s easy and usually accurate – yay for me!

Although to be truthful, I was not expecting to see the elevated levels of confrontation between Iran and the United States, nor could anyone have realistically predicted the attacks on the Abqaiq processing facility and Khurais production centre in the Saudi Arabia, not to mention the New Year’s Massacre on the road to the Baghdad airport (word of warning – if you are target #1 on the terrorist watch list, you don’t actually need to show up 3 hours early for an international flight).

As an aside – isn’t it great that we can use unmanned drones now? That’s putting those video game skills to great use. At the end of the last quarter I said there is nothing that Trump would like more than an opportunity to venture out against Iran to distract from his domestic disaster which now includes impeachment, unredacted emails and other “stuff” – that was actually a pretty good call.

And now we have protests in Iraq, where people want good government (go figure) and those protests threaten to disrupt the energy economy there.

Not to be outdone we have the protests in Hong Kong, which while not predicted specifically by me, I will nonetheless assume full credit for, because, well, I can. So there.

The other theme I discussed was an unfolding global economic slowdown and the rising recession risk in North America and Europe as well as a trade and debt induced economic shock in China. If the inverted yield curves weren’t enough of a flashing red light for policy makers in the United States, the recent spate of disastrous PMI indices and Manufacturing data should be. Industrial production, employment and trade numbers indicate underlying weakness and are trending downward, supported only by lingering strength in services. The combination of massive corporate and government debt and persistent deficits, unnecessary and unproductive trade wars and the flashing red warning signals the stock market is giving should make everyone sit up and take notice. While recession risk in the United States has moderated thanks to Trump’s Phase I tariff deal capitulation and consumer strength – against this backdrop, Canada is and always will be collateral damage. Fingers crossed, eh?

Another prediction I made was that the Donald Trump trade war would come to an end so that the world can recover some semblance of an even keel. Is it happening? Kind of. True to Trumpform, there are a lot of announcements and very little in the way of progress, although the China Phase 1 is a start. USMCA finally got passed (in an omnibus vote with impeachment! Not really, but pretty much) and the US and the UK are likely to negotiate a deal of some kind in the next 3 years, so there you go. Trade wars are fading in time for the election – that is all.

The next part of the qualitative forecast is harder to assess. I suggested that 2019 was going to be hard for the Donald and clearly this is the case. Nancy Pelosi has established permanent residence in Donald Trump’s head and the impeachment limbo is clearly driving Donald nuts. The Ukrainian ShakedownTM impeachment and upcoming Senate trial promises to be a circus. Right now there is no way of accurately predicting how it’s going to go, except that partisan lines are likely to prevail notwithstanding some rough edges either way.

I suggested that if Donald Trump makes it through 2019, re-election odds rise significantly. But right now I feell that needs to be taken with a grain of salt – his base is soldi but he is losing votes and support across all categories and a war with Iran doesn’t get him re-elected, it only distracts from other issues.

On the energy front, my predictions really centered around the lack of exploration being initiated outside of the Permian and the day of reckoning that is coming. With OPEC+ finally taking the supply side seriously and Saudi Arabia determined to lower inventories, that lack of investment should come home to roost in 2020.

Thematic Grade? B. Got a bunch of cupcake calls right but can’t get too excited.

Production

Our prediction on production is of course area dependent but as always starts with the madness that is the Permian, West Texas and the rest of shale-mania. Our forecast was increased production in the United States of up to 800,000 bpd, closing the year at 12.5 mm bpd.

Based on weekly numbers, US production closed the year at 12.9 million bpd, which represents growth of 1.2 mm bpd – 50% higher than forecast. But weekly numbers are estimates, I will wait for the monthly numbers to assign a final grade.

US Production Grade – B. US numbers are problematic as no one likes the weekly data anymore. Anecdotal evidence from industry suggest a slowdown but the EIA continually suggests growth. They can’t both be right.

In Canada, notwithstanding current curtailment policy, we predicted modest growth in production – on par with last year, probably in the order of 250,000 to 300,000 bpd of oil with growth coming from oilsands, the conventional world and condensate. This prediction was predicated on both crude by rail and Line 3 seeing significant advancement and that did not happen.

Canada Production Grade – F – thanks for nothing Minnesota, the Kenney government’s fumble on resolving the crude by rail file and pretty much anyone I see on the street.

An aside about curtailment. Our prediction was that the curtailment job is done, time to get out of the way and let the market finish the job. Given pipeline developments, this appears premature.

Curtailment Grade – Incomplete

OPEC production levels were predicted to be flat year over year depending on what happens with the new OPEC/NOPEC agreement at the various jump-off points through the year. The key to the agreement is the Saudi/Russia collaboration continuing in press releases if not in practice. After the last meeting it is pretty clear that OPEC+ will keep production in check (well except for record production in Russia) so this was a pretty decent call.

Grade – A

The rest of the world was supposed to see limited growth this coming year. A lot of projects are making noise (Brazil) but they are years out from making a dent. Africa is a significant growth area this year and is attracting significant investment, worth keeping an eye on. Norway? Interestingly divesting from fossil fuels and lecturing the world on a sovereign fund basis while growing production more than 10% – conflicted much?

Price of oil

As always the glory call. And this year I went as bullish as bullish can be because I believed the bullish case would win the year with Middle East confrontation and Permian relaxation. Clearly I was premature. But a good start to 2020, amirite?

So, while I still believe the bullish case for oil wins in the long run – it didn’t happen this year. On the plus side, I predicted oil prices to be pretty volatile during the year, so there’s that. My year end price is $80.03 but my average price for the year was $61.47, so a late year run-up. At the end of Q4, the price of oil was $61.06 and the average was $57.07. I think I needed a shooting war in Iran.

Grade C – Close enough for a pass, but better luck next year

Price of Natural Gas

Ah natural gas, I can’t quit you! Super cold winters, massive consumption, LNG and we still can barely catch half a break on pricing. Notwithstanding another massively bullish call, it’s going to be a long year.

My year end price forecast for natural gas was $3.90 with an average price of $3.26, up marginally from last year. At the end of Q4, the price was $2.19 and the average was $2.57.

Too. Much. Supply. I. Give. Up.

Grade D.

Activity Levels

On the Canadian side, this year was posited as a hard one to predict given the curtailment policy of the Alberta government, egress issues and all that.

The basic prediction was an unmitigated disaster for Q1, self-correcting through the first half with a rally of sorts in the second half of the year.

I was almost on track if you replace the words “rally of sorts” with “regional pockets of modest activity” with a dash of unmitigated disaster spread throughout the year

The rig count lagged last year’s levels and to be completely honest, isn’t going to change much until curtailment is dead and buried regardless of government tinkering with incentives.

It was just a crappy year all around.

Grade F – Everyone shares the blame on this one

Unlike Canada, the US had significant growth last year in both rig count and production. That said, the rig count has fallen considerably since the end of Q2. While Permian drilling growth continues, albeit at a more managed pace, US activity is definitely off across the board.

The longer we sit at a range bound price for oil in the mid to high $50’s the more discipline will be imposed on LTO players, further suppressing activity.

I noted last quarter that in the Schlumberger year end call, they estimated that soon 75% of all US drilling will be just to maintain production levels. And since pretty much everyone is publicly traded and needs to show at the least maintenance of production, US activity must absolutely continue. So I guess that gives us a baseline for drilling activity. Note that while you think that would be the case for Canada too, it is important to note that 75% of our production is from the oilsands which have a 3% annual decline as opposed to 35% or more in LTO.

While good for Canada in the long run, this really doesn’t help my forecast.

Grade C – Everything slows down eventually.

M&A Activity

We predicted that M&A activity in Canada would pick up as the curtailment issues settled out and infrastructure got more certainty. M&A in the US was expected to pick up as well as assets changed hands and companies consolidated acreage. This year we have seen a few interesting deals. Devon sold to serial aggregator CNRL at a significant discount. Pieradae stole some gas assets from Shell. And in the US, Anadarko was subject to a bidding war between Chevron and Occidental which Oxy “won” for an absurd valuation. Go figure.

In Q3, the US recorded the highest volume of upstream M&A since 2009, highlighted by BP buying BHP assets in the Permian, the Eagle Ford, and the Haynesville basins for US$10.5 billion—the biggest acquisition for BP since buying Arco in 1999. Another big deal was Diamondback Energy buying Energen for US$9.2 billion, creating the third-largest pure play Permian producer. The shale consolidation continued in Q4 as in excess of $30 billon in assets remain on the block and bankruptcy filings accelerate.

In the services sector we expect to see activity pick up through the end of the year, certainly on the private company side, focused strongly on infrastructure and production maintenance. It did – a bit. Mostly for our clients.

LNG construction is under way and it is hard to ignore as an opportunity. Money will follow.

Just not yet.

And it does bear repeating to all my American readers – Canada is a currency advantaged, rational valuation and stable market for consolidators tired of the madness in Texas. BUY, BUY, BUY. Oh, did I mention… BUY?

Grade C – A “meh” year for sure

Canadian Dollar

We said the Canadian dollar should see some relative stability this year with the commodity price, but a slumping economy is going to counterbalance that. We are currently at $0.77 and I predicted $0.78.

Grade B+ – not sure how I feel about getting currency right. Pretty boring

Infrastructure

I know on the surface things look bleak, but it may surprise people outside of the energy sector that we are in the midst of an energy infrastructure supercycle in Canada. This should continue well into the 2020s and includes everything from midstream to pipelines to LNG to renewables. I went out on a limb and predicted the following for 2019:

- Line 3 complete and operational by year end (missed that, curse you Minnesota)

- TransMountain Expansion underway in the summer (good call, depends on your definition of both “underway” and “summer” but it is full steam ahead now)

- Keystone XL back in play later this year (things are looking up on the KXL front with US government approvals, but TC Energy needed to get building this summer)

- Coastal Gas Link fully underway this summer (yup)

And I thought maybe one more LNG FID this year. Which we got, just not the big one. So there.

Grade B

Stock Picks

Since last year was such a disaster, I decided to pick some names I was more familiar with and also a few… outliers. Still not sure of the wisdom of this, but it was worth a shot.

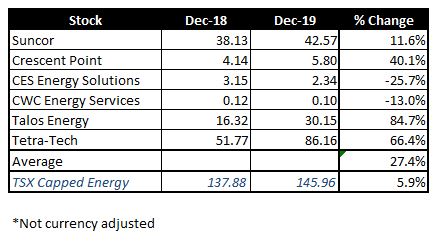

True to my rules, this year I picked two Canadian E&P’s as well as two service companies and, finally, one American producer and one American service company. As a reminder, the companies were as follows:

- Suncor. A core holding if you want to play Canada.

- Crescent Point. The down-trodden once golden child trying to reinvent itself.

- CES Energy Solutions. CES provides chemical solutions and services through the lifecycle of the oilfield ranging from upstream through pipelines and downstream.

- CWC Energy Services. Small cap service and I know the CEO and he’s a pretty smart guy.

- Talos Energy. A pure-play Gulf of Mexico producer with current production of 55,000 boe.

- Tetra-Tech. Consulting and engineering in the areas of water, environment and infrastructure.

Here goes nothing…

Wow – nowhere near the train-wreck I thought it was going to be – thank you random bet on offshore GOM junior.

Grade A!

Overall?

I give it a solid B-

That’s it. Next week my “genius predictions” for next year. Hide your nest egg!