One of the benefits of doing this weekly coffee call that I have been pursuing these last couple of months is not only do I get to have far-ranging conversations about a host of topics with an engaging group of people, but I also get to use it as occasional inspiration for blog topics. And let’s face it, the last few weeks have been a bit of a challenge for me.

At any rate, this week I am taking inspiration from something we discussed a few weeks ago. The subject was the upcoming Conservative Party of Canada leadership race that as you know I consider to be a bit a right-wing nut job pandering dumpster fire, which I suppose all leadership races have to be because the crazies vote in disproportionate numbers in party elections. Regardless, the talent pool this go around is a bit thin, at least in my coffee panel’s estimation and we got talking about.

And don’t worry, this isn’t going to be about the CPC leadership convention, too which I have already dedicated more words and time in these few paragraphs that I ever thought I would. Rather, I’m thinking of a promise I made to assign odds to the outcome of that race and a few other things to facilitate some side bets amongst the crew.

Plus, Vegas casinos reopened last night, which I forgot to mention last week. What could possibly go wrong?

So there you have it. I’m giving odds, I may take money. I may allow prop bets and parlays. I’m handicapping outcomes and running a race sheet.

There may be a sting to set up, and I’m stacking the odds in my favour. The sharps are invited to give me their best.

There may not be any ponies at Pimlico or thoroughbreds at Churchill Downs, but rest assured, your gambling desires can be sated here at “Stormont High Stakes House of Gaming”, soon to be available online once our registration in Gibraltar is complete.

Simply put, I have decided to run a book. I’m officially a bookie. And my mom said I’d never amount to anything!

All of the odds are presented in American moneyline format. A negative number represents the underdog and is the amount paid out on a notional $100 bet. The positive number goes to the favourite and represents the amount you would need to wager to win $100.

The Big Bets

CPC Leadership race

I know I said I wouldn’t write about this but goshdarnit if it wasn’t the catalyst for this entire blog fiasco this week. So I’ll do this quick. This is now a more exciting three-way race with front-runner Peter MacKay duking it out with Erin O’Toole for the thankless top job and Leslyn Lewis putting in a very strong stretch run. MacKay should carry this in a runaway. He has done everything right. He looks the part, he has gravitas. He has history. He took time away from politics to marry a Muslim woman and raise a family. He’s from the Maritimes. But he lacks a spark. There is absolutely no excitement in this campaign.

Still, I am calling MacKay the favourite at -250, O’Toole at +150, Lewis +750 and that whack job Sloan clown a complete flyer at +10,000.

Presidential election

No, not the result, this is a bet on whether there will actually be an election. It’s a popular bet because, well, there is a large constituency that believes there is no way Trump wants to potentially give up power and what better way to ensure that by not having an election at all! And really, with the pandemic still making headlines and chaos in the streets, there is precedent after all for cancelling elections – unfortunately that’s in places like Syria that are ruled by despots. Hmm.

In all reality, despite Trump’s norm destroying actions, the election train is near impossible to stop, so this one gets -1000 for election and +10,000 for no election.

Presidential election

Assuming that you actually believe there will be an election, this one is the big bet as it will for better or worse determine the direction of the world for the next decade. Pitting incumbent Donald Trump and his stump of a VP against Joe Biden and an as yet to be named but in all likelihood African American woman, this is a battle for the ages. Biden leads in every conceivable poll and unless the economy executes an abrupt u-turn, he is the favourite. Just for fun, I have thrown in some wild cards, just in case you want to be separated from even more money.

Biden is -250. Trump is +100. Pence is +750. Hilary is +1500. Sanders is +1000. Parnell is +10,000.

Canadian election

This next bit is going to be a bit of a prop bet on whether or not the next Canadian election will be before the US election or after. With the Liberals riding sky high in the polls, it may be worth taking a stab at crushing all opposition once the new CPC leader is chosen, but waiting allows them to campaign on a post US-election result.

Pre-November is +750, post November is -250.

Most likely month and year for next Canadian election

Well if you are into this kind of thing, you’re really into it, so let’s play a little game of chance. The last few Canadian elections have been in the fall, but if the Liberals really want a mandate they may need to move faster. The most like scenario is a 2021 election and I am going to say spring time.

So, 2020 is a +100. 2021 is -100. As for months,

Prop bet – next horrible thing to happen in 2020

I saw this presented as a bingo card on social media and there were many bizarre options. I think each one has a relatively similar likelihood of happening. Here are my top 5 awful things that could still happen in 2020.

- Sniper monkeys are real -150

- Milli Vanilli Reunion Tour -250

- Trump declares himself emperor for life -10,000

- COVID-20: -12,500

- Toronto wins Stanley Cup: -9,500

Length of recession

Now of course we start to get into some of the more serious stuff. I mean it can’t all be fun and games. There is little doubt that we are in a deep recession as a result of the pandemic lockdown. Ironically, both Alberta and Saskatchewan were in a recession at the end of 2019, so for us this is nothing new. The big debate of course is how deep and for how long. Will it be a V shaped recovery or a U or a W. Many schools of thought and a lot dependent on infections, the rate of recovery of the US consumer, the likelihood of a vaccine, the depth of the demand and supply shock, state of supply chains, government stimulus – you name it. We are already seeing recovery in employment numbers which is promising and energy prices are showing signs of life. At any rate, rather than alphabetical, I am going to position this as a simple over/under bet on the time to get back to pre-recession GDP levels in the US, which should likely carry Canada along for the ride.

Less than one year -225 and more than one year +150.

Odds of OPEC++++ keeping it together

Ironically the odds on this one keep shifting around as more evidence comes out that a whole bunch of these clowns haven’t even implemented the cuts they were supposed to. Yes, I’m looking at you Iraq. Now there is news that Libya may return some production. On top of that is all the uncertainty around Russia’s commitment, no one being able to pick a date to have a meeting (this weekend now? I thought it was going to be at the end of June!) and a level of complacency now that prices have risen to the $40 range.

Keep it together for the rest of the year +100. It all blows up and destroys the energy market as we know it -100.

Tight Oil Recovery

A lot of speculation out there about the light tight oil world, what the actual decline numbers look like, how much production is actually shut in and how many bankruptcies there will be. So there are a number of questions here, all very gameable.

How low can you go. US production appears to have peaked for the foreseeable future back in March and the decline has been as dramatic as the demand destruction. But we are still unsure of how far it can fall before the end of the year. Personally, I feel the official stats from the EIA are understating the level of drop off but I have no real way of proving it. That said, I feel the over/under here is 10.5 million barrels of oil per day which would mean a fall in production in the United States of about 2.5 million barrels. Seems about right. This line can move based on next week’s reports.

More than 10.5 mm bopd: +50. Less than 10.5 mm: -100

Busy Insolvency guys. The over/under for bankruptcies in the LTO world is about 250, but with the recent rally in prices to close to $40, some pretty aggressive bidding has now moved that line closer to 200. The 200 level is probably closer to reality because as the weaker parties drop off, there is more opportunity for survival for the ones left standing.

More than 200 bankrupticies by year end: -125. Less than 200: +100.

Where’s my mojo? With prices rallying, many people are starting to float the idea that maybe the worst is behind us and that LTO will miraculously rise from the dead and soon be chugging along as if 2020 never happened. This feels a tad misguided to me as it doesn’t take into account current company finances, the lack of liquidity for the market, the challenges and expense of restoring shut-in production (a lot never comes back), the absolute cratering of rig counts and the prospects of a hostile to fracking Biden presidency. The question thus is can LTO recover to previous heights in the short term.

Yes: -1000. No: +500

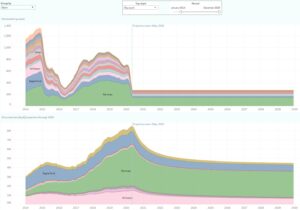

Don’t believe me? The chart below shows what happens to production if the rig count flat-lines at current levels.

Oil Prices

What a change a month will bring, right? From -$37 to a current level around $40, WTI has been on a tear and that’s as it should be. Prices were definitely artificially low even with the demand destruction brought on by COVID. That said, I saw a $70 by year end forecast just today so I think it’s important that we pump the brakes on that right now. Getting to $70 assumes that no production that has been shut in can be brought back and that OPEC doesn’t unwind its massive cuts. While possible that in-demand products such as heavy oil will see premium pricing (wouldn’t it be great to have a pipeline) as the recovery begins in earnest, discounting the impact of all this production coming back is just setting the bulls up for slaughter. We all know what can happen with minor tweaks to storage numbers. For me the question is will WTI oil prices end the year above or below $50.

More than $50: -225. Less than $50: +25

Pipelines

This one is pretty straightforward. Canada has four major pipelines that we really care about. TransMountain Expansion, that we own. Coastal Gas Link to bring natural gas to the BC coast. Keystone XL to connect to Texas and Enbridge Line 3 to the US Midwest. This is all pretty straightforward yes or no bets with the question being: Will this project get completed in the next 5 years. Buckle Up.

Keystone XL is the biggest and arguably most important to Canada of the oil pipelines. It is currently on hold because of permitting appeals related to water crossings. Presumptive nominee and (according to the odds) future president Joe Biden has vowed to kill it. I’ve come full circle on this. Without a Trump II, I think KXL is dead.

Yes built: -1000. No: +1000.

TransMountain Expansion. Symbolically the most important pipeline, it’s also the one most firmly under our control. With construction on schedule and now moving into BC, the prognosis here is quite good.

Yes: +250. No: -625

The Enbridge Line 3 Replacement was initially the most shovel ready of all the projects but now finds itself a political football as well. With the Canadian portion completed in 2019, all we needed was a some reasonably cooperative permitting in Minnesota to allow Enbridge to hit their end of 2020 timeline. Well just this week we learned of more delays by regulators in the land o’lakes as concerns about, you guessed it, water crossings are arising (this seems to be the new weak point for these projects). At any rate, a slam dunk suddenly appears at risk.

Yes: +50. No: -50

The Coastal Gas Link project will link NE BC’s prolific gas formations with the LNG Canada export facility in Kitimat. This project is key to Canada’s LNG aspirations and seems to have so far escaped the capex massacre that has occurred at majors all around the world and Shell is persevering. While still subject to negotiation with First Nations groups along the route, as long as LNG Canada is alive, so is this project.

Yes: +200. No: -250

Whither Canada’s Energy Sector

This is the perennial debate. Absent government interference, the Canadian energy sector is diverse, innovative and a robust contributor to the national well-being. In the current environment it is marked by skepticism about its survival, hostility from the environmental movement and certain left-leaning cohorts of our national government and pipeline and pricing concerns all across the board. Some people posit that “oil is dead” and thus the energy sector should be shut down or phased out. Others look at the global landscape and see LTO collapsing, Venezuela and Mexico fading and a world much more consumed by energy security than at any time in the past 40 years. One thing I have learned in my 22 years here in Calgary is to never bet against the resilience and adaptability of Canada’s energy sector. If there’s a way, we will find it. So, to the question. Will Canada’s energy sector emerge from the pandemic and be favourably positioned by the end of 2020. Yes or No.

No: -250. Yes: +250

There you go. The book is set. If you want to play along, send me your picks and bets. I will pay out the winners in “Stormont Bucks” that can be redeemed for one on one time with the Office Cat. All participants will be tracked.

Office Cat

Office Cat visited me only once this week, which was sad.

Stormont Capital Crude Coffee

We had the seventh edition of this last Tuesday at 2 PM (I double booked) and it was another great conversation.

Topics included… The Calgary Green Line and public transportation, privatizing ATB and a big free for all on municipal politics.

This week I promise to track down another interesting guest who isn’t me, although I reserve the right to blather away about stuff I want to talk about.

Prices as at June 5, 2020

- Oil

- Oil storage was… down? (that was unexpected – product was up though)

- Production was down

- OPEC+++++ cuts start biting

- Natural Gas

- Storage was up, historically very high; consumption down; production flat; exports flat.

- WTI Crude: $39.06 ($35.19)

- Western Canada Select: $31.19 ($28.09)

- AECO Spot: $1.891 ($1.854)

- NYMEX Gas: $1.850 ($1.862)

- US/Canadian Dollar: $0.7405 ($0.7256)

Highlights

- As at May 29, 2020, US crude oil supplies were at 532.3 million barrels, an decrease of 2.1 million barrels from the previous week and a increase of 49.1 million barrels from last year.

- The number of days oil supply in storage is 41.3 compared to 28.9 last year at this time.

- Production was down 200k for the week at 11.200 million barrels per day. Production last year at the same time was 12.400 million barrels per day.

- Imports fell to 6.179 million barrels from 7.200 million barrels per day compared to 7.927 million barrels per day last year.

- Crude exports from the US fell to 2.794 million barrels per day from 3.176 million barrels per day last week compared to 3.298 million barrels per day a year ago

- Canadian exports to the US fell to 2.860 million barrels a day from 3.274 million barrels per day last week

- Refinery inputs increased during the current week to 13.307 million barrels per day

- As at May 29, 2020, US natural gas in storage was 2,714 billion cubic feet (Bcf), which is 18% above the 5-year average and about 39% higher than last year’s level, following an implied net injection of 102 Bcf during the report week

- Overall U.S. natural gas consumption rose 3.9% during the report week.

- Production was up 0.5% for the week. Imports from Canada rose 4.7% from the week before. Exports to Mexico were up 4%.

- LNG exports totaled 36 Bcf

- As of June 5, 2020, the Canadian rig count increased 1 to 21 (AB – 11; BC – 6; SK – 2; MB – 0; Other – 2). Rig count for the same period last year was 58.

- US Onshore Oil rig count at June 5, 2020 is at 206, down 16 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States is down 1 at 76

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 1 at 13.

- Offshore peak rig count at January 1, 2015 was 55

US split of Oil vs Gas rigs is 86%/14%, in Canada the split is 66%/34%

Trump Watch: Insurrection!

Kenney Watch (new!): Needs a haircut. Bill 1 – don’t protest.

Trudeau Watch (for balance): 21 second salute to Trump