Three more months. That’s all there is to this miserable year. Three more months until my Fearless Forecast, such as it was, is assigned to the raging dumpster fire of shattered dreams – exactly where it belongs.

While usually around this time of year I am celebrating my unique genius for predicting the future and basking in the praise of one and all for what is, truly, a gift, instead I am sitting here, a broken shell of a prognosticator. Where once I was compared to the Sage of Omaha, instead I am the Gasbag of Calgary.

No matter. I am nothing if not resilient, so I will take my lumps like a true man – with my eyes closed and cringing in the corner. Then, like the phoenix, I will rise from the ashes and do it all again. Hopefully phoenix-like, because I don’t think I could handle Sisyphus right about now.

Sure, directionally I have gotten some things right and I may be close to my year end forecast for average oil prices, and gas looks good. But nowhere did I ever think we would see penny stock volatility in the most important commodity on earth or that the disconnect between the financial, physical and stock market for oil and gas companies would play out in sunch stark and counter intuitive fashion. As I say often on Twitter – we are in the upside down.

Notwithstanding all this, the price of oil remains elevated and producers are once again preparing to report quarterly results that will be the envy of governments everywhere. It is some small consolation that while it is unconscionable that your energy stock is trading at some insulting like 1 x EV/EBITDA, at least the 10% plus yield is a star in the market.

Or is it? Because the market seems unable to realize that in a high inflation, high interest rate, high risk of recession market the stocks you want to own are the ones that pay cash now, as opposed to fantasy ones that may deliver growth in five years. But what do I know?

Ah. That felt better. Now, on with the show!

First, the shameless caveat.

My Forecast, which was predicated on a relatively peaceful outcome to Russian military muscle flexing on the Ukraine border, has been thrown into disarray by the events of the past seven months and Russia’s unprovoked, incomprehensible and globe destabilizing invasion of Ukraine.

Much like Covid in 2020, most of my conclusions “for the year” are upended, or at least crazily uncertain. However, I take the lesson from that year to heart. With the passage of time, things tend to settle down, volatility is occasionally reduced and a lot of the “noise” tends to fade away. There is a reason why we forecasters (eye roll) often look at trailing averages (3, 6, 24 and 36 months) to get better informed about what is happening to the economy writ large and other large secular movements as opposed to living exclusively in the moment.

Like really. What could go wrong next? It’s not like the French are going to nationalize their electric utility or anything.

Finally, in the interests of my commitment to brevity, in my quarterly snapshots of my forecast and the report card that falls out of that, I will attempt to dispense with the usual commentary and flowery descriptions and keep to the matters at hand – what I forecast and how far off or psychically bang on I was. And consistent with Q1, Q2 would be called “swing and a miss”.

Here Goes, The Report Card…

Broad Themes

The Fearless Forecast starts with Broad Themes and tries to distill these themes into more concrete predictions. Sometimes it works, sometimes not so much.

I had three obvious themes and they permeate a lot of what I predicted. They aren’t surprising and they remain very relevant.

- The rising I’s. Inflation and interest rates

- Energy Security vs Energy Transition

- Enough Already aka Pandemic Exhaustion

Each of these will in some way inform and influence all that follows

Politics and Stuff

This year I predicted a rocky road for Empathetic Joe Biden heading into the all-important mid-term elections where it is accepted wisdom that a newly elected presidential ticket and party will get their asses handed to them by a feisty and impatient electorate. And if it seems like the US is always in election-mode, it’s because they are. It’s uniquely exhausting, like a pandemic.

While Earnest Joe Biden has done his best to build back better and be bafflingly boring, the reality is that while his personal electoral win was a landslide by any objective measure, the legislative majority was much more tenuous. The result is that he has been stymied in getting his full agenda implemented and the January 6th Commission, is not something that engages the public at large. While the hearings are now public, the narrative is continually hijacked by events on the ground.

Since the last report card, Biden has passed his Inflation Propagation Act and had some other legislative wins and the Republicans have gone on an “own goal” bender of blocking voting rights, advancing the most medieval anti-abortion laws they can come up with, immigrant bashing, white supremacist pandering, Putin supporting and Q-Anon love-fests. On top of all this, we have the Former Guy front and centre with all of his issues, legal and otherwise.

Finally, the great Strategic Petroleum Reserve gambit of 2022 which saw 180 million barrels of oil enter the market in the 180 days leading up to the mid terms has actually had its desired effect – gas prices are down significantly and as everyone knows, Americans vote based on gas prices first and foremost, everything else is secondary.

So, the mid terms are up in the air.

My first prediction, which will handily not need to be judged until November, is that the balance of power will tilt the GOP way in the Senate, but not the House, meaning 2023 and 2024 will see either horse-trading or nothing of significance getting done in the US, sidelining much of the rest of the Biden agenda, in particular those priorities that relate to more left-leaning causes and, importantly, the environment, which has also been ruled unconstitutional by the Supreme Court.

It looks like I may have a miss on this one.

This shift of power and what it entails will depend a lot on what happens with Trumpism, such as it is. I predicted that Unproductive Trumpism (the greed, the insults, the rage), much like a cockroach, will die a slow death. I also predicted that while the threatened 2024 Presidential run is still very much in play for Donald Trump, it was unlikely to happen.

The jury is out on this one, but Trump’s legal troubles are mounting.

I also predicted that at least indictment of Trump will go forward (does a civil suit count?) and the distraction will drop him from the ticket. A guilty verdict in either disqualifies him. I also suggested a decisive win in 2022 for the GOP will embolden them to move on from Trump, while, ironically, a (extremely unlikely) decisive loss might also accelerate the ditching of Trump even more.

Also, Hilary doesn’t run in 2024 either. Good lord, I may get this wrong too!

So where are we at? Still too early to tell but I think Biden is going to do better than expected and we apparently will have to suffer through a lot more Trump than we want to. The January 6 hearings continue but is anyone paying attention? Also, I don’t think enough people appreciate the gravity of Trump’s document “borrowing”.

Grade: Incomplete.

Here in Canada, we have had our Federal Election about nothing with nothing results. The Liberals continue to interpret their win as a mandate to implement their entire platform as if they are a strong majority government and their new dalliance with the Federal NDP for support means that as I predicted they are pretty much free to do what they want.

That said, in Canada, pandemic exhaustion has definitely set in. The people are restless. Housing prices are still out of control across major markets but could soon collapse under the weight of skyrocketing borrowing costs, productivity is falling, the economy is underperforming, inflation is on the march and the Liberal government doesn’t seem to have anything remotely approaching a plan, let alone a business case, for dealing with anything..

This is a major problem because as interest rates keep rising and a recession looms, we actually need a government focused on the economy, not the latest performative environmental gesture.

Housing, inflation and energy are the governing Liberals Achilles Heel. The Liberals hubris-driven obsession about the environment above all else will prove their eventual undoing as regular Canadians see their prospects get sucked into a vortex of inflation, rising interest rates and recession.

I hedged but I said I wouldn’t be surprised to see an election in Canada this year. I predicted new leadership for each of the major national parties. Well at least I’m 1/3 there, and the Greens are leaderless at the moment.

Grade: C+. The election isn’t going to happen, but we have new leadership in the form of Pierre Poilievre in the CPC, a distinct lack of leadership from the NDP and everyone hates Trudeau. If the Liberals dropped the writ today, their prospects look pretty dim.

On the international side, my predictions were for a return to and continuation of some regional tensions.

Let’s deal with the bear in the room first. I said Russia was a big deal to the United States and Europe and a lesser deal to other countries around the world and that while Russia appears to have grand aspirations of territorial or influence expansion, they are a fading power. I suggested that even with the massing of troops, even Putin isn’t crazy enough to invade. He wants his gas pipelines open so he can own European energy insecurity even more than he does. The gambit I saw was influence and fortune, not hegemony.

There is no passing grade here. Putin has wrecked a country and is in the process of permanently crippling his own, but at least there is oil money. For now. The gas games he has been playing with an insecure Europe have come to a head with the sabotage of the Nordstream pipelines which will likely NEVER re-open. Militarily, Russia is losing in Ukraine and nuclear sabre-rattling is at Cuban Missile Crisis levels. The shirtless war criminal riding a stolen horse remains in power for now, but his best before date has clearly passed.

The Iran crisis, which has been ongoing for more than 40 years will continue to percolate. A robust nuclear program is their goal and they are well on their way. I suggested Biden may jump into a new JCPOA deal if energy prices persist at high levels if only to increase “official” supply. Then Ukraine happened. The US very much wants these barrels added. Or at the very least use the spectre of a deal to talk oil prices down. But it’s hard to do a deal with a repressive regime that is killing women for taking off a hijab, supplying drones to Russia and serving as a back door for Russian energy sales while bombing its neighbour Iraq. Like I said, it’s complicated!

China is a belligerent and annoying problem. Clearly their goal is to challenge the US for dominance in the Pacific, Africa and South America. Donald Trump misplayed this by being so inwardly focused. Biden risks exacerbating this by being distracted by Russia and Iran. Biden will need to build a much broader coalition to deflect China’s economic might and thwart some of its more malign ambitions. Hong Kong is gone. Taiwan is for sure next, but that’s probably a 2023 priority for the CCP who are going to spend 2022 deleveraging and then re-energizing their economy. Then Ukraine happened. And China picked cheap energy from Russia.

South America, including Venezuela which is in its 1229th year of economic stagnation seem to be on a bit of a razor’s edge with inflation accelerating across the continent. Brazil and Argentina aren’t as stable as they were just a few short years ago. There is a strong potential for internal conflicts. Then Ukraine happened and suddenly Maduro is fielding calls from Oily Joe Biden. On the flip side, elections of leftist politicians in Ecuador and Colombia have put those countries’ energy industries on notice that their services are no longer needed. This is 1 million barrels at risk.

Lastly, Africa, whose countries comprised more than half of the top 10 humanitarian crises list for yet another year will continue to be a pawn for the major powers. Then Ukraine happened, everyone is likely to starve and no one cared, not even the UN, who apparently are just fine with starvation as a population control tool.

Grade for all this is incomplete. The fallout from Ukraine and the realignment of the world order will unfold over decades, not months. What it looks like in the end is anyone’s guess, but the longer that military action continues in Ukraine, the worse and more isolating it will be for the Russian regime and the more problematic it will be for its cynical quasi-supporters in China and India. The Western World, for want of a better term, has the wealth and resources to wait this out. NATO is stroner than ever. Russia’s economy has been set back 20 years by sanctions, maybe more. It is not good.

Energy and Environment

On the energy and environment front, my prediction was that 2022 was going to be a year of transition but not of the variety we typically talk about.

Instead, the story was to be dominated by energy (in)security and energy pricing. Mostly of the rising variety.

Well, I got that right. But not for the reasons I thought were clear.

The logic for rising prices was as follows:

The entirely predictable result of the human tendency to pursue one track at all costs (renewables and net zero) has been a breakdown in the energy security compact, with prices rising in almost exponential pandemic fashion across the globe and transitions running into the harsh reality of winter, scarcity, inflation, human nature, development aspirations, lack of investment, intermittency, realpolitik and cost. Not to mention the invasion of Ukraine and the resultant energy insecurity and price.

The global energy system is like a living and breathing entity with each part inter and intra-dependent. Late 2021 Europe and early winter 2022 was just a prelude and with prices spiking after the Ukraine invasion, people want a scapegoat. And in the 2022, I said that scapegoat might be the entirety of an all too rapid attempted transition to net-zero.

It is the end of Q3 2022 and while energy prices have come off their highs, they remain elevated. With inflation rampant, the price of solar and wind is rising. Minerals are scarce and supply chains are wrecked. The cost of capital is about to start increasing dramatically with interest rates. Subsidies that once seemed easy-peasy are suddenly becoming a burden on national treasuries.

I said something had to break and it wouldn’t be the oil and gas industry.

Absent Ukraine, the oil supply situation was dire. While the LTO train managed to recover some ground in 2021, they will require sustained price increases to overcome regulatory and financial hurdles to get back on a growth curve. A global lack of investment has seen supply get squeezed. OPEC can’t meet their quotas, drilling productivity in the Middle East is in the tank. Mexico is so concerned about internal self-sufficiency; they are planning to stop exports. South America is cutting back. Joe Biden is draining the US’s energy savings accounts. Meanwhile, the fantasy of windmills, solar panels, EVs and endless access to virtually free capital is taking a long time to be shattered.

On the natural gas front, in every country aside from Canada there is a desire to produce and have more natural gas, whether through domestic supply or imports via pipeline and LNG. Then a couple of pipelines got blown up. If ever there was a time for the fifth largest producer of natural gas in the world to get its head out of its ass and realize the “business case” for natural gas, it’s now. But what do I know?

My prediction for 2022 was that we are on the verge of one of the biggest oil runs we may have witnessed in decades. Canada’s oilsands are going to kick ass in 2022.

So far, so good, right? Energy stocks were the runaway star performers of the markets right up until late June, when in the space of 20 days, we gave it all back. Stocks have recovered a bit, but it’s still choppy. The next quarter will be a big deal I think.

Of course, on a cash flow basis, these companies are totally kicking ass. And pouring money into the Alberta government’s secret stashhouses.

It wasn’t all bad for the renewables world. I did after all predict a continuation down the energy transition pathway – albeit through several detours and construction zones.

These are pretty broad themes/predictions, but they need to be. I believe the transition will happen. Still. But it’s a bumpy ride. And it has just gotten a lot more expensive to execute. Inflation. Interest rates. Cost of capital. These things matter.

Oh yeah, electric vehicles. 2022 will see the major automakers finally strike back at Tesla. Elon’s going to be going through some things. Like buying Twitter. And being exposed as a philandering dickhead.

Grade? So far so good. The price of oil ran ahead of itself on global tensions and now is untethered from the fundamentals of the physical market. This is leading to a lot of volatility. The energy transition continues but it’s becoming much more of an “all of the above” plan for energy security with Europe now deciding that nuclear and natural gas are “green” and every world leader (except Trudeau) realizing that the path to energy security is actually having access to all forms of energy.

Price of oil

This is the flagship call of the Fearless Forecast. Based on my monumentally bullish call above and the war in Ukraine, I’m clearly all in on black gold.

First off, I expected oil and gas demand to increase by about 2%-3%, to 102 mm bpd as economies continue to reopen. How this demand is met is the biggest question for prices. If it comes from OPEC+++++++, with Saudi Arabia managing the market, I don’t see a wave of supply. With Russia pre-occupied and treated as a pariah, the situation is even worse.

Inventories are declining and by mid year we could be hitting a wall as decline rates and lack of global investment in prior years bite the industry in the proverbial butt. Traditional suppliers are unable to ramp up supply fast enough – Iran will likely still be under sanction and Venezuela is out. OPEC isn’t meeting quota, Mexico is pulling in its horns. The US is struggling to get dollars allocated from GameStop, Bitcoin and Tesla into LTO wells in the Permian. This ironically (or fortuitously) leaves Canada as a place that can actually provide a steady, low decline and predictable supply. But we have no pipelines. Any SPR release is short term political expediency and must end at some point.

This is all of course bullish for prices. Which means of course that the price cooperated for a bit then cynically stabbed me in the back.

My year end WTI price is $86.23 and my average price for the year is going to be $82.34. September 30 price is $79.69 and the average YTD is $98.52.

A truce in Ukraine, a significant ramp up in non-Russia production or recession caused demand destruction is good for a $10-$15 drop in oil prices, so I think I am in the ball park on this one.

Grade: Pretty good for a gambler.

Price of Natural Gas

Ah natural gas, I can’t quit you!

For too many years, natural gas has been disappointing me and pretty much all of Canada with lousy pricing for what seems like forever. Flashing great potential at times before collapsing back to “super-cheap alternate fuel – why don’t we use even more of it” status.

But finally, the worm has turned. Gas consumption in the US is way up. Exports of LNG are growing rapidly and exports to Mexico are also rising. Europe’s electricity crisis has exposed the soft underbelly of the energy transition, the need for gas-fired power generation, and lots of it. Pipelines are blowing up. Demand is through the roof. We are in a mini Golden Age for gas production in Canada – there is finally a business case!

With everything happening in Europe, gas prices there are absolutely bonkers – trading at an economy killing $300 WTI equivalent. THE TIME IS NOW!!!

My year end price for natural gas (NYMEX) is $4.23 with an average price of $3.84. I predicted that AECO will again have a better year than I think many Canadian producers are used to, which, combined with oil sands prospects will generate sufficient royalties to eliminate Alberta’s deficit by 2023 and see Jason Kenney re-elected if he survives his leadership review this April. Which he will, by the slimmest of margins. All of this was correct – except he quit anyway. Oopsie Poopsie.

Actual prices at the end of Q3 were an average of $6.75 and a closing price at September 30 of $6.83 (per MCF).

Grade: B. I underestimated the demand side, the LNG pricing spillover into the US and the Ukraine wild card needs to play out. That said, prices feel overdone, but winter is around the corner.

Production, Drilling and Capex

For many producers in the Permian and continental United States, I said drilling would recover with prices over the course of the year, but it isn’t going to be dramatic as players watch prices, wait to see what the Biden administration will try roll out for emissions regulations and struggle to get increasingly expensive capital allocated to them.

Of course, now the Biden administration is looking to replace millions of barrels per day of Russian production to stabilize prices, bring gas prices down and avoid a midterm massacre and all eyes are turned to LTO.

But there’s a problem.

To maintain production against its epic decline rates, the US LTO industry needs to drill and complete thousands of wells every year. To grow this requires an even larger investment amid regulatory certainty.

Capital for new drilling programs is scarce and cost is rising. Share buybacks, discipline, debt reduction, dividends are the order of the day.

The monstrous DUC inventory has been mined and the dirty little secret of the DUC count is that probably a quarter of these were never going to completed anyway. Rig count has continued to grow with prices, but break evens are rising with drilling costs as inflation and supply chain issues continue to impact an industry that consumes a tremendous amount of raw material.

The Biden administration continues to cling to a green agenda that died when Manchin slammed the regulatory door and then Putin invaded Ukraine.

Given all of the above, the incentive to drill is weak.

Drilling activity and capex in the US is expected to be up 10%. It’s going to be a different year for American drillers – still activity, but the ongoing commitment to capital discipline will make things seem tight.

We believe that US production can grow, but it’s going to take time. My initial forecast was 12.0 mm boepd for year end. With the current crisis I suspect we may get closer to 12.5. That’s not a lot. That said, recent data suggest 12.5 is super aggressive.

In Canada, I predicted activity levels should over the course of the year more closely resemble what some are hoping they can call a “normal” year. Intensely active areas of conventional unconventional (tight oil, deep basin, condensate, liquids rich, natty) activity in places like the Duvernay/Montney/Viking and the Bakken but not much in between, at least for the first part of the year. Maybe some pick up in heavier areas as the year progresses. Rig count will also pick up in British Columbia as drilling to support LNG Canada picks up. Continued optimization and slow-footed brownfield expansion in the oilsands will continue, but not much more. Costs will rise due to inflationary pressures. Lack of manpower will hold back many programs and contribute to wage inflation.

While the year will be massively bullish for oilsands producers and investors, the market signals are not all in for any material capex driven expansion. For Canada I predicted not much growth above replacement of natural declines, notwithstanding recent record production levels. With Ukraine, everyone wants our non-psycho oil but egress holds back any material expansion. The Feds promised 300k boepd. We could do it, but not sure how we would ship it.

Fortunately we conveniently avoided committing to sending Germany and LNG. It’s a good thing there is no business case for that.

I confidently predicted that activity in Western Canada will be … about 10% ahead of 2021.

Expect to see 6,000 (+/- 300) combined oil and gas wells drilled in 2022. Capex should be up 10%, with an upside for 20%.

OPEC production levels will depend on what happens with the re-upped OPEC/NOPEC agreement at the various jump-off points through the year. At current price levels, OPEC is just below the goldilocks zone and will use its perceived market power as a regulator. After the invasion of Ukraine, OPEC has stuck with its targeted production increases with pretty much no one hitting their quotas ever, even while Biden went cap in hand to ask them to increase production they can’t actually do. What a world.

In the rest of the world, it was a limited growth scenario. New projects in the North Sea will continue to ramp up and investments in Africa (Gabon) will come on-line. Latin America will be sold as a growth area – look for Brazil to disappoint because that is what they do – but material growth is, as always, a couple of years out.

The Russian invasion has picked the scab off the absurd lack of investment in the oil and gas sector and overreliance on a limited number of sources. Inventories can come down very rapidly and that is a difficult trend to reverse once it starts. Russia aside, demand continues to recover from the pandemic induced consumption decline, and when consumption snaps back above 100 million barrels of oil a day by year end (which it will) a poorly managed supply expansion and resultant additional price spike could stick a pin in the global economy. We actually need production growth. Just not too much, so we can keep the party going.

Grade: B. Regardless of Russia, I am pretty confident that the world isn’t going to deviate too much from my forecast. The next quarter will test my fortitude.

M&A Activity

I predicted a robust trend to continue through 2022 as property consolidation, non-core asset sales and private equity investment all pick up as the industry adjusts, yet again, to a new normal. Expect the M&A activity to be broadly based – upstream, downstream, oil, gas, services and everything in between.

On the Canadian side, I predicted M&A activity should pick up as portfolio rotation out of inflation sensitive sectors brings American and international investors back to Canada and our absurdly high Free Cash Flow yields start to attract interest. In addition, expect a prominent Canadian name or two to find themselves with new foreign owners as the year progresses.

Also, with all this cash, still low valuations and nowhere to put it, I predicted at least one Canadian name is due to take itself private. My thoroughly scientific Twitter poll had 190 votes and 41% said Whitecap and 32% said Baytex.

There were some deals of note in the first nine months of the year and we are now looking at a more robust M&A environment with assets sure to change hands in the near future. Warren Buffett can’t be the only one seeing this opportunity.

So far this year we have the following:

- Whitecap bought XTO Energy for $1.6 billion

- Harry Hamm offered to take Continental Resources private

- Warren bought Oxy

- Tamarack Valley bought Deltastream

- Teck is contemplating selling Fort Hills

- The Total Energies Canadian portfolio is in play

- Tourmaline bought Rising Star

- Cenovus invested in a refinery before it blew up

- Strathcona Resources bought Serafina

- Devon acquired Validus

- Centenial acquired Colgate

- Oasis acquired Whiting

The Sector, she is now in play.

On the services side, I was bullish on energy infrastructure and related industries and see that as an area where Canada will see a fair amount of activity. Mid and downstream oriented companies will continue to be of interest to strategic consolidators and private equity.

In the new Russia reality, Canadian companies represent a stable investment in an unpredictable world. Put another way:

Canada is a currency advantaged, undervalued and stable jursidiction for consolidators tired of the madness in other markets. Global recovery tight supply indicates a commodity super cycle, likely the last big run of many careers including mine. Russia only upped the ante. Show me the money people!

Grade: Incomplete. Expect the next quarter to be very active.

Canadian Dollar

It was expected that he Canadian dollar would see some relative stability this year with commodity prices, but instead it has been subjected to the global wrecking ball that is the US dollas. Our overdependence on unproductive real estate was a flashing warning sign. Will our government pay attention? Judging by the Federal budget and tepid response to inflationary pressures and energy insecurity, they don’t get it. Every country around the world has blown its brains out with debt the last year to spend out of the pandemic but on a relative basis, Canada is not a leader. Inflation in Canada is running slightly behind the US and our economy is underperforming which means the Bank of Canada can’t be as aggressive as the US Fed to raise rates, which will drag on the dollar. I expected the Canadian dollar to close the year around $0.82. Ouch.

Grade: Lousy. Recession talk. Oil volatility. Lack of investment. Being leapfrogged by a hawkish Fed. A rush to safe havens driving up the US dollar and general apathy to Canada has meant a range-bound dollar has been laid low, trading below $0.74. We are so screwed. If only there was a business case for propping up the dollar!

Interest Rates and Inflation

Inflation is a major global issue no matter how many people tell you it is transitory. Transitory is a stupid term. Rising prices beget rising prices. Producer Price Inflation (PPI) in the US is running about 5% higher than the CPI which is running above 8%. The PPI is a leading indicator to CPI. We have months to go before things settle down.

Despite giving back some gains, energy prices have risen by close to 50% and lack of investment suggests this is a new plateau. Housing prices – both prices and rent – remain at record levels – not only in Canada but around the US and the rest of the world.

Asset bubbles in tech, crypto, NFT, art and other markets peaked in Q1 by any objective measure and the whole thing has blown up spectacularly in a wave of insolvencies, margin calls, grift and fraud. And all it took was a 2%-2.5% increase in the Fed Funds rate. What a stable market we created with crypto.

Wage growth is running rampant everywhere except Canada (yay for us?). Supply chain disruptions continue, some are permanent. The renewables transition is sucking up every spare ingot of nickel, copper and other base metal around, raising prices for solar panels, wires for electrification and ultimately energy prices. Again.

Now we have a war involving one of the largest energy producers in the world and two of the largest wheat exporters.

These are not transitory signals. There is a red engine light is flashing on the dashboard. We’ve been ignoring it too long. I predicted rates to increase by 150 basis points in the US and Canada this year. I said I wouldn’t be surprised to see the US start with a 50 bp increase early in the year. People made fun of me for being too aggressive. Ha!

I also predicted a soft landing for the economy as long as we could keep oil prices below $100. Ooopsie Poopsie. Jay Powell is telling everyone who will listen that a Fed induced recession is coming. He’s mentally incapable of lying. It’s coming.

Grade B – Aside from in the UK, all central banks globally remain hawkish and Russia wrecks everything. Fed Funds rate has already gone up 2.25% this year with more to come. Bank of Canada is doing their best and have raised rates by 2.00% and our currency is in the toilet. This story is still playing out.

Infrastructure

Here’s what I predicted for 2022:

- TransMountain Expansion crossing the midpoint with multiple spreads operating during the year in Alberta and BC

- Coastal Gas Link continuing notwithstanding current challenges

- NGTL Expansion well underway

- Continued Petchem investment

- Signature CCUS projects

- Renewables projects galore including utility scale solar, wind and storage projects including

pump storage.

People are spending money. In Western Canada. Of all places! On something other than real estate.

Grade: Winning! It’s all happening. IPL’s Heartland Petrochemical Complex produced its first plastic pellets at the end of Q2. Unfortunately the lack of a business case for LNG continues to hold back serious investment.

Stock Picks

Last year was a disaster of sorts. I underperformed the index, and my renewables pick was almost exclusively to blame.

This year I was determined to hit it out of the park, and to use my main themes – energy security and inflation, to guide my picks.

There is no Russia, Russia, Russia pick.

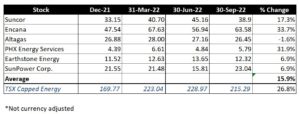

True to my rules, I picked two Canadian E&P’s as well as two service-oriented companies and, finally, one non-Canadian producer and a service company. I do a formal review at year end. All you get now is a table. Apologies to my Twitter gurus. My picks are bad.

Grade: D. I may be underperforming my benchmark, but the benchmark doesn’t have to hold a renewable, a service company and two US companies. Also, what’s up with Encana? Big year so far.

My time here is done.

Invest wisely. Don’t short the Fed.