Is it the end of Q2 already? All I can say is thank god! It has been a long one what with elections and pipelines and sanctions and all things Trump. And it is that blessed time of year here in Calgary called Stampede and if you are wondering why this blog is a day late and a dollar short, you can blame my buddy Kim and his First Friday party which happened to coincide with my usual blog posting time. Beer, party, blog. Blog, party, beer. Party, beer, blog. Pretty easy call actually. I hope I didn’t upset anyone.

While I will attend a number of Stampede events and use those events as my guide for what the next six months might look like for the Calgary economy, unfortunately for me, the end of a quarter and a halfway point in the year means that it is time to assess my Fearless Forecast TM and see where I’m at.

If you’ve been following the energy market, you know that my stock picks have likely all been taken out behind the wood shed, but that shouldn’t surprise anyone, the last few years have been underperformance defined. I do think I am hitting it out of the park on some of my broad themes of unrest and chaos, but in a world of Trump, this is kind of like taking a candy from a baby.

But let’s look at the results before we rush to pass judgement. In fact, I will look at the results and pass judgement myself, and trust me, I won’t go easy on me. Or something like that.

And before I start – yes, I know. How can someone in industry be so wrong about this stuff?

Broad Themes

The forecast for this year started with civil unrest, particularly in the Middle East, which, now that I think about it a bit was a giant cop out. After all, what could be easier than predicting unrest in Iran, Iraq, Israel, Palestine, Yemen and other places, especially with US sanctions biting in Iran, Syria doing that Syria thing, ISIS being defeated, Turkey and Russian meddling. The usual. So a bit of a cop out of a forecast even though it is pretty much spot on every year. In fact it is the easiest forecast one can make in geopolitics. And of course it does playout as it is supposed to month after month, year after year.

Although to be truthful, I was not expecting the elevated levels of confrontation between Iran and the United States even though I am not surprised by them. As an aside – isn’t it great that we can use and shoot down unmanned drones now? Same level of rhetoric but no one gets hurt. Donald Trump saw this when he decided not to risk “up to” 150 Iranian lives because some trigger happy dude in Iran shot down a model plane. Some trades are too one-sided even for the Donald.

And, not to be outdone we have the protests in Hong Kong, which while not predicted specifically by me, I will nonetheless assume full credit for, because, well, I can. So there.

The other theme I discussed was an unfolding global economic slowdown and the rising recession risk in North America and Europe as well as a trade and debt induced economic shock in China. Recent indicators in North America are mixed but policy makers are rightly freaked out about inverted yield curves in both Canada and the US. Industrial production, employment and trade numbers indicate underlying weakness and are trending downward, but have not yet breached soft landing territory. That said, the combination of massive corporate and government debt and persistent deficits, unnecessary and unproductive trade wars and the flashing red warning signals the stock market is giving should give everyone pause. And as bad as the numbers may look in the US, the European and Chinese indicators are all much, much worse. Current recession risk in the United States is rising and Canada is not immune from contagion even if some regions are seen as doing OK. Notwithstanding all the self-promoting bravado, the fact that Donald Trump keep sharping on the Fed to lower rates suggest to me his advisors are all telling him that the economic downside heading into an election year is high.

Another prediction I made was that the Donald Trump trade war would come to an end so that the world can recover some semblance of an even keel. Is it happening? Not as fast as it should but at least China and the United States are in negotiations although, true to Trumpform, there are a lot of announcements and very little in the way of progress. Mexico and Canada steel tariffs have come and gone, the border tariff threat was empty, and the Chinese escalation appears to be slowly walking back. Against this we have potential European tariffs and a free trade agreement with Canada, the US and Mexico remains to be approved. Lots of uncertainty. As I said in my forecast, I have zero confidence in the ability of anyone involved to extricate us from this madness so, as I said, buckle up.

The next part of the qualitative forecast is harder to assess. I suggested that 2019 was going to be hard for the Donald and I still believe this to be true. He has lost the House and can no longer govern via executive order with impunity. Nancy Pelosi is a more than capable check on the Trump and the Democrats have the GOP on the run in many areas. With the economy slowing and no one believing in the border wall emergency it would seem the deck is stacked. But the Mueller report kind of fizzled, impeachment is sending the Democrats running for the hills so it seems like the Donald is, for now at least, off the hook on Colluuuuuuusion. For now. Half way into the year, the White House is in flux and it’s hard to say who has the upper hand. I think the Democrats believe they have all the cards, but Trump is the President and is able and willing to use the levers of power, which the opposition seems to fear. So, less impunity, but not as dire as it seems. If he makes it through 2019, re-election odds rise significantly.

On the energy front, my predictions really centered around the lack of exploration being initiated outside of the Permian and the day of reckoning that is coming. With OPEC+ finally taking the supply side seriously and Saudi Arabia determined to lower inventories, that lack of investment should come home to roost later in the year. Let’s all hope OPEC has some spare capacity when it is called on in Q4.

Thematic Grade? B. Directionally OK, but still a work in progress.

Production

Our prediction on production is of course area dependent but as always starts with the madness that is the Permian, West Texas and the rest of shale-mania. Our forecast was increased production in the United States of up to 800,000 bpd, closing the year at 12.5 mm bpd.

I think we can still get there, but the first half of the year was, for want of a better term, mixed. Drilling rigs were off in the United States by the most in several years as operators paid lip service to capital discipline and instead focused on reducing the number of DUCs. And a funny thing happened on the way to the oilfield – initial production rates are taking it on the chin, child wells are a growing problem and well spacing is being expanded on the fly. Activity continues to expand in the Gulf though, as predicted, potentially offsetting any speedbumps in the Permian.

US production closed the quarter at 12.1 million bpd, realizing more than 25% of the year’s predicted growth but expect that number to stagnate for a while.

US Production Grade – B. A decent start, but as producers churn through their DUC inventory, the forecast may fall short.

In Canada, notwithstanding current curtailment policy, we predicted modest growth in production – on par with last year, probably in the order of 250,000 to 300,000 bpd of oil. This will come from both oilsands, the conventional world and condensate. And it’s going to come in the second half of the year. That said, this prediction was predicated on both crude by rail and Line 3 seeing significant advancement and right now that isn’t happening.

Canada Production Grade – Incomplete – heading for a fail, thanks for nothing Minnesota.

An aside about curtailment. Our prediction was that the curtailment job is done, time to get out of the way and let the market finish the job. Given pipeline developments, this appears premature.

Curtailment Grade – Incomplete

OPEC production levels were predicted to be flat year over year depending on what happens with the new OPEC/NOPEC agreement at the various jump-off points through the year. The key to the agreement is the Saudi/Russia collaboration continuing at least until June. We now know that the Saudis are producing well below their quota in a bid to rapidly restore balance and the agreement has been extended by another 9 months.

Grade – A

The rest of the world was supposed to see limited growth this coming year. A lot of projects are making noise (Brazil) but they are years out from making a dent. Africa is a significant growth area this year and is attracting significant investment, worth keeping an eye on. Russia? Well, they can grow production, the question of course is will anyone buy it, given their ongoing contamination issues..

Price of oil

As always the glory call. And this year I went as bullish as bullish can be because I believed the bullish case would win the year which is still possible. Plus it’s fun to be bold, even if you miss.

While I still believe the bullish case for prices wins, I predicted oil prices to be pretty volatile during the year. My year end price is $80.03 but my average price for the year is going to be $61.47. At the end of Q2, the price of oil was $58.48 and the average was $57.45. I think I will hit the average, but probably need a shooting war in Iran to hit my year end.

Grade B- – directionally right but too soon to tell.

Price of Natural Gas

Ah natural gas, I can’t quit you! Super cold winter, massive consumption, LNG and we still can barely catch half a break on pricing. Notwithstanding another massively bullish call, it’s going to be a long year.

My year end price for natural gas is going to be $3.90 and the average price will be $3.26, up marginally from last year. Fingers crossed. At the end of Q2, the price was $2.31 and the average was $2.69.

I. Give. Up.

Grade D.

Activity Levels

On the Canadian side, this year was posited as a hard one to predict given the curtailment policy of the Alberta government, egress issues and all that.

The basic prediction was an unmitigated disaster for Q1, self-correcting through the first half with a rally of sorts in the second half of the year.

So far I’m solidly on track.

The rig count was consistently 30% below last year’s levels through Q1 and an early breakup has flat-lined activity. That said, there are promising signs for H2.

Our forecast was flat with last year and of course we must stick with it. But it’s really too early to tell and if we get one more piece of bad news, we may all just move.

Grade D – Not looking good so far

Unlike Canada, the US had significant growth last year in both rig count and production. That said, the rig count has flat-lined for most of the first half. While the Permian drilling frenzy continues, we predicted the large inventory of DUCs will hold back the rig count and drilling activity somewhat in the first half. Keep in mind that the Permian has similar offtake issues as Canada, although with a higher will to solve them.

That said, there is still cash flowing into the investment incinerator that is tight oil and the incentive to drill will always be there, regardless of price or profit since as was widely reported after the Schlumberger year end call – soon 75% of all US drilling will be just to maintain production levels. And since pretty much everyone is publicly traded and needs to show at the least maintenance of production, US activity must absolutely continue. Ouch. Of note, we have none of thise issues in Canada, we just trade at super steep discounts to asset value, have massive dividend yields and take luxurious baths in free cash flow – not that the market would notice…

Grade – C – Incomplete.

M&A Activity

We predicted that M&A activity in Canada would pick up as the curtailment issues settled out and infrastructure got more certainty. And we are sticking to that. For Q3 and 4. Devon sold to serial aggregator CNRL at a significant discount. Pieradae stole some gas assets from Shell. And in the US, Anadarko was subject to a bidding war between Chevron and Occidental which Oxy “won” for a n absurd valuation. Go figure.

Similarly, we expect the services sector to see activity pick up in the second half of the year, certainly on the private side.

LNG construction is under way and it is hard to ignore as an opportunity. Money will follow.

Just not yet.

That said, Canada is a currency advantaged, rational valuation and stable market for consolidators tired of the madness in Texas. BUY, BUY, BUY. Oh, did I mention… BUY?

Grade C – Incomplete

Canadian Dollar

We said the Canadian dollar should see some relative stability this year with the commodity price, but a slumping economy is going to counterbalance that. We are currently at $0.76 and I predicted $0.78. We need an actually growing energy sector to get there or a deliberately tanked US $ from el Trumperton, so the fingers are crossed.

Grade B

Infrastructure

I know on the surface things look bleak, but it may surprise people outside of the energy sector that we are on the cusp of an infrastructure supercycle in Canada and I still believe that. This should continue well into the 2020s. Out on a limb and don’t fit me for a straight jacket, but I fully expected to see the following in 2019:

- Line 3 complete and operational by year end (missed that, curse you Minnesota)

- TransMountain Expansion underway in the summer (good call, depends on your definition of both “underway” and “summer”)

- Keystone XL back in play later this year (things are looking up on the KXL front with US government approvals, but TC Energy needed to get building this summer)

- Coastal Gas Link fully underway this summer (yup)

And we may get one more LNG FID this year. So there.

Grade B

Stock Picks

Since last year was such a disaster, I decided to pick some names I was more familiar with and also a few… outliers. Still not sure of the wisdom of this, but it was worth a shot.

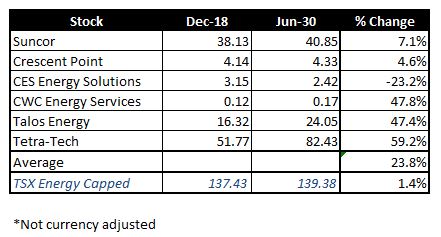

True to my rules, this year I picked two Canadian E&P’s as well as two service companies and, finally, one American producer and one American service company. As a reminder, the companies were as follows:

- Suncor. A core holding if you want to play Canada.

- Crescent Point. The down-trodden once golden child trying to reinvent itself.

- CES Energy Solutions. CES provides chemical solutions and services through the lifecycle of the oilfield ranging from upstream through pipelines and downstream.

- CWC Energy Services. Small cap service and I know the CEO and he’s a pretty smart guy.

- Talos Energy. A pure-play Gulf of Mexico producer with current production of 55,000 boe.

- Tetra-Tech. Consulting and engineering in the areas of water, environment and infrastructure.

Here goes nothing…

Wow – so far so good. I’m just going to leave it at that.

Grade – A.

Overall – B!

Yahoo!

Happy Stampede everyone!