Wow, has it been a year already? I guess it has, and here I sit in my office transfixed by the opening rounds of my favourite sports tournament of the year and contemplating the meaning of college sports. And as always, as my basketball bracket implodes and I see all my bets wither and die, I am reminded that the big dance is also happening in the energy world and, as tradition dictates, I need to do my picks.

Last year was a pretty intense energy tournament and my final match up was a doozy, featuring Black Swan against OPEC, with Black Swan winning as OPEC got overwhelmed by events outside of their control and needed to retool.

This of course was a fairly prescient prediction as the toothless Iranian sanction regime imposed by the United States forced OPEC to ramp up production and sewer the oil market at precisely the wrong time. That said, in the interests of fairness, in order to properly assess my predictive chops, it is worthwhile to also take a look at my actual “basketball” picks from last year.

Let’s see, in my actual Final Four I picked University of Virginia v Xavier and Villanova v Duke. UVA over Villanova. This is instead of Kansas vs Villanova and Loyola Marymount vs Michigan and Villanova beating Michigan for the championship. So that pretty much sums that up. I had one of the right teams and my picks were all wrong.

Gambler’s advice? Take my predictions with a grain of salt – please. And only rely on me for the early round wipe outs.

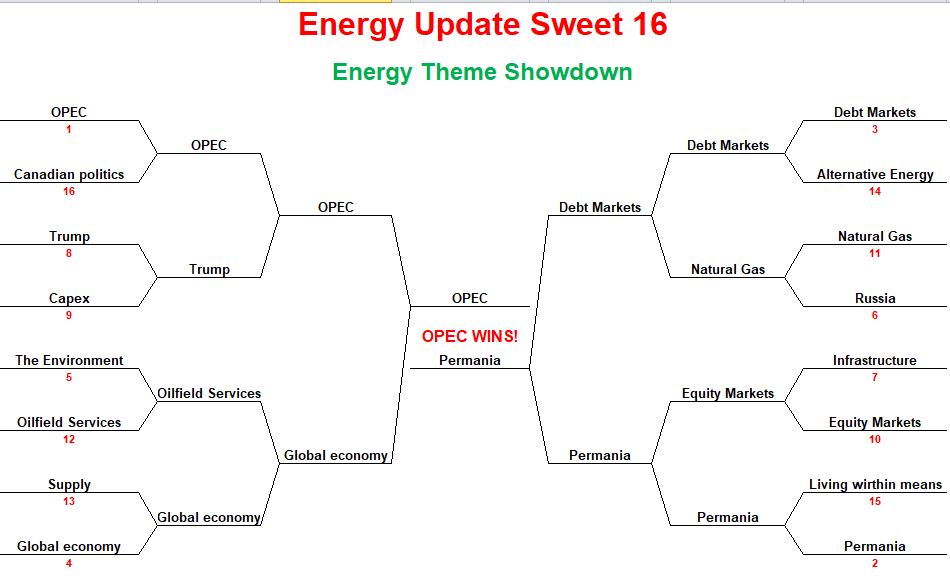

As always, this year’s players in the energy bracket are a little different than last year. The early rounds saw some interesting matches and upsets. Much of Canada as we know is officially out or relegated to the junior tournament, but familiar names such as OPEC and Russia remain and Permania – now coached by the disgraced Rick Pitino is still hanging around thinking they are the best thing going.

So without further ado, the major themes face off against each other in an epic battle for global relevance.

Sweet Sixteen

In the first game, perennial favourite and retooled number one seed OPEC faced off against upstrart number 16 seed Canadian Politics. While there was considerable hype before the game – mainly from the media – about Canadian Politics newfound buzz and excitement, and they did score occasionally, they were no match for the professionalism, size and dominance displayed by the top-ranked team and defending champion. True to form, Canadian politics talked a good game but ultimately couldn’t deliver the win.

In an ironic seeding, the number 2 seed, Permania, finds itself matched up against up and comer, analyst favourite very responsible concept Living within means. LWM plays a very conservative old school four corners game – bottom line focused and driven by probabilities and economy of effort. Unfortunately for LWM, they were no match at all for Permania and all its hype. At times it seemed like Permania didn’t actually care about Living Within Means at all and engaged in a display of show-boating and pandering to the crowd more reminiscent of the Harlem Globetrotters than a serious team.

Debt Markets, the number 3 seed, absolutely crushed Alternative Energy which can’t seem to get much traction in the tournament. The deciding moment of the game (aside from tip-off) was at the end of the first half when Alternative Energy came up empty and Debt Markets got a stimulative boost from its favourite player The Fed.

In a match featuring two new players, 13th seeded Supply took on a surprisingly potent Global Economy. In what was billed as a classic matchup of supply and demand, it turned out that supply, while not completely over-rated was still a bit of a paper tiger. It didn’t take long for Global Economy to assert its dominance and run away with the game.

Moving to the middle of the bracket, the team rankings get closer and the upset potential that much more probable. In a big surprise, Natural Gas has moved from a 16 seed last year to a much more competitive 11 seed. Matched up against Russia, it seemed like Natural Gas was out of its league, but spurred on by support from its European fan base, Nat Gas got its legs towards the end of the game and held off a furious rally by the dour Russians. As this is the second year in a row that Russia was eliminated in the first round of the energy tournament, it is clear that heads will roll. Literally.

10th ranked Equity pulled off what for a moment the upset of the tournament against the 7 seed Infrastruture. Once an important player in the energy community, Infrastructure was plagued by an inability to finish, particularly when their Canadian players didn’t even bother to show up. Even super sub Justin came up empty handed.

Not to be outdone, the upset of the day went to the plucky downtrodden Energy Services team who pulled off a shocker against perennial favourite The Environment. A doormat for the past few years, Energy Services was buoyed by some of the new technologies it has been using in its training recently and was also helped by a youth movement which has seen it develop a lot of younger and hungrier players eager to make their mark. The Environment appeared to be just a step slow and while their cheering section was typically loud and boisterous at the beginning of the game, once the lead was lost they moved on to support another team.

The last matchup of the opening round was YUGE pitting number 8 ranked Trump against Capex. The game was played live on Fox, which created a second sports channel called TFS (TrumpFoxSports) just for the occasion. The Capex team started strong and had good support from the crowd but soon the orange crush started to and some blows and before long was mocking the capex team to its face and grabbing the coach by the … Capex, which was used to a much more structured game was too off-balance to mount much of a resistance. The most telling moment of the game was a savage dunk by Team Trump point guard KellyAnne Conway posterizing her husband and calling him a loser. Ultimately, Trump won – was there ever any doubt? Remarkably, they didn’t even cheat this year.

Elite Eight

A number of intriguing matchups in this round.

The first was a rematch from the past two years with the underdog Trump trying yet again to best and outplay OPEC. While able to use bully and intimidate Capex in the first round, the OPEC team was much more implacable in the face of the typical onslaught of no-look passes, recycled Harlem Globetrotter head-fakes, buckets of confetti and assorted flim-flammery. OPEC, upset in the final last year, by the Black Swan created by Trump was all business in this game and proceeded in its own inexorable fashion and countered every move with a calm and purpose. There is no way they were going to be tricked in this game and the outcome was never really in doubt. By the end of the game, the Trump team had had so many ejections by referee Bob Mueller that Nancy Pelosi had to come out of the stands to help out.

In another highly anticipated matchup, Cinderella-story Energy Services went up against the Global Economy. While Energy Services represents a very small sub-sector of the world and can be a feast or famine team prone to streaky play, Global Economy draws players from around the world and has great balance. The Energy Services group acquitted themselves admirably but unfortunately it wasn’t meant to be this year. The Global Economy was determined to make its mark in the tournament and Cinderella was soon sent packing with its broken glass shoes in a box.

On the other side of the bracket, we got to see a matchup of Debt Markets, always a major player, going up tournament surprise Natural Gas. Debt Markets were big a few years ago and while they still dominate, they have been known for periods where they lose their discipline and the end comes quickly and spectacularly. Fortunately for them, this Natural Gas team, which had seemed so dominant in the colder climes faded away fast as spring sprung. Unforced errors, over-production, too many men on the court. By the second half, it was clear that Debt was on a collision course with either Equity or Permania.

Which of course was the last match of the day. An epic confrontation between Permaina and Equity Markets. Equity started strong, playing defence against the relentless attacks from Permania, but proved pretty much useless in standing its ground. Equity tried again and again to impose its will on the drillers from Texas but to no avail. At one point, Permani8a had actually stolen Equity’s uniforms and lunch money. It was a rout. Permania for the win.

Final Four

In the opening game of this round, Permania found itself matched up against Debt Markets. In a matchup of hype versus the black hats you had to know all bets were off. While the expectations were for a very cautious game, more a tactical fight than a free wheeling Phi-Slamma-Jamma dunkfest, it soon became clear that the Permiana team did not in any way feel intimidated or even care about Debt Markets. Permiana ran out to a massive first half lead and went to the lockeroom certain the were going to roll over a beaten down debt market. In the second half, Permiana seemed a bit off and the starting five tired quickly and they were forced to bring in the B team comprised of children and wells off the sweet spot and at that point Debt Markets started to make up ground very rapidly. Ultimately it came down to the last possession, Debt Markets up 1, trying to run out the clock, when Permiana was able to steal the ball from Debt Markets star point guard Jerome Powell (Fed Chair) and heaved up a last second three that went in and Permiana advanced..

In the second match, top seeded OPEC took on the Global Economy, and it quickly became apparent that while Global Economy was by far the larger and more physically dominant team, OPEC was by far the more flexible, able to respond rapidly to any tactical shift on the part of the Global Economy, either pressing the issue on defence, a three-point shooting barrage or switching over to four corners. In the same domineering style that it demonstrated two years ago on its championship march, OPEC demonstrated strength, resolve and discipline that Global Economy just couldn’t match, and won the game going away.

Championship

OPEC vs Permania. A rematch from two years ago, this game was truly a battle of the heavyweights, with OPEC a narrow favourite coming up against big, bad, brash and flashy Permiana, whose confidence at this stage, notwithstanding the close call with Debt Markets, was pretty sky high. True to their form all through the tournament, Permiana raced out to a massive lead in the first half but as the second half started, the classic OPEC tactical adjustment happened and the long game started to make inroads against Permiana who was once again required to put a bunch of less-seasoned and far less productive reserves into the game. As victory seemed to slip inexorably from its grasp, Permiana began desperately looking for a saviour on its suddenly thin bench. First it tried to work with its smaller child-like scrubs but they were useless, then they snuck a few debt markets and equity markets subs on, but they were no match at all for a resurgent and suddenly supremely confident OPEC. In the last minutes of the game Permiana pulled out all the stops and was able to bring Trump out for one last hurrah. While the fan-base that was very much in support of Permania thought this might spur their team, it appeared to have the opposite effect as the OPEC team seemed to catch another gear and by the end of the game was dunking with abandon. OPEC wins in a runaway. Was it ever in doubt?

So there you have it – agree or disagree, it’s hard to argue that the metaphor got taken behind the proverbial woodshed and beaten to death.

Oh yeah, Final 4 – University of Virginia v Kansas and Michigan v Duke. UVA over Duke. Done like dinner. Sorry Zion, enjoy the NBA. Go Cavaliers. Go Charlottesville.

Prices as at March 22, 2019 (March 15, 2019)

- The price of oil was up this week on modest production gains and supply concerns.

- Storage posted a decrease

- Production was up

- The rig count in the US was down marginally

- Withdrawals from storage were flat with expectations for gas. The market was unmoved

- WTI Crude: $58.93 ($58.36)

- Western Canada Select: $49.33 ($47.69)

- AECO Spot *: $2.29 ($2.70)

- NYMEX Gas: $2.758 ($2.790)

- US/Canadian Dollar: $0.7490 ($0.7500)

Highlights

- As at March 15, 2019, US crude oil supplies were at 439.5 million barrels, a decrease of 9.6 million barrels from the previous week and 11.2 million barrels above last year.

- The number of days oil supply in storage is 27.4 compared to 26.4 last year at this time.

- Production was up for the week at 12.100 million barrels per day. Production last year at the same time was 10.407 million barrels per day.

- Imports rose from 6.746 million barrels to 6.932 million barrels per day compared to 7.077 million barrels per day last year.

- Exports from the US rose to 3.392 million barrels per day from 2.546 million barrels per day last week compared to 1.573 million barrels per day a year ago

- Canadian exports to the US were 3.518 million barrels a day, up from 3.389

- Refinery inputs rose during the during the week to 16.198 million barrels per day

- As at March 20, 2019, US natural gas in storage was 1.143 billion cubic feet (Bcf), which is about 33% lower than the 5-year average and about 22% less than last year’s level, following an implied net withdrawal of 43 Bcf during the report week

- Overall U.S. natural gas consumption fell 8% during the report week

- Production for the week was flat. Imports from Canada increased 4% from the week before. Exports to Mexico decreased 2%

- LNG exports totaled 24.8 Bcf

- As of March 22, 2019, the Canadian rig count was down 56 at 105 (AB – 85; BC – 15; SK – 3; MB – 1; Other – 1. Rig count for the same period last year was 157.

- US Onshore Oil rig count at March 22, 2019 is at 824, down 9 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was down 1 at 192.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was unchanged at 22.

- Offshore peak rig count at January 1, 2015 was 55

US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 68%/32%

Trump Watch: Lots of weird Twitter this week, I’ll just leave it at that.