Don’t you? Because well, here we are. A mere 7 weeks into 2021 and already the whole thing is going to heck in a handbasket. No, I’m not talking about the debacle that is the NHL season south of the border where games are being cancelled willy-nilly due to COVID exposure. Nor am I talking about the latest vaccine fiasco (no, there isn’t another one, it’s a figure of speech) with the Federal government dropping the ball on procurement for enough weeks to get hammered by the opposition and the provinces who will soon be fighting a rearguard action of their own as their actual vaccine execution plans come under strain from a tsunami of product.

Nope, none of that. Instead, I have questions about things. Questions that need answers. And I’m going to start with a bit of a Q&A about the Polar Vortex that swept southward from Canada into the United States last week (for the record, we sincerely apologize) and the crisis in Texas and the complete an utter failure of renewables in the face of a little cold weather. Whoops? Did that slip in? Sorry. Did I say failure of renewables? Not at all what I meant, I just have read so many ill-informed takes on what happened over the last week that it was a subconscious reaction – which I guess is what the commentary hoped would happen….

What I meant to say was the complete and utter failure of the electricity system in the face of a once in a hundred years, unpredictable weather event, including renewables.

Or was it? I guess that’s the first question.

Or more precisely, the first question is: what the heck happened in Texas?

I suspect we all know the basics by now but it’s worth revisiting the lowlights:

A polar vortex descended on Texas. Temperatures collapsed to historic lows (wind chill in Houston!). The electricity system was overwhelmed by demand and was forced into rotating blackouts. Heating systems failed. Water treatment failed due to lack of power. Ted Cruz fled to Cancun. People have died. And everyone is pointing fingers at each other and assigning blame. And that blame game is being driven by politics and not facts on the ground. And it is being deliberately obtuse.

But why should that be a surprise?

And what is really going on? And where to start?

Well, how about Super Bowl 45, because as we all know, it’s always about football isn’t it.

Anyway 2011. February. First time in Dallas. The world tuned in. Green Bay vs Pittsburgh.

What could go wrong?

As it turns out, plenty. Starting with a Polar vortex (sorry) and ice storm. Sound familiar?

Wait, I thought this year’s polar vortex (sorry) was a 100-year storm? Nope, it was a 100-year temperature drop. Splitting hairs, but important.

So 10 years ago a massive cold front (again courtesy of Canada – sorry!) brought ice storms, blizzards and cold temperatures to Texas just like we have seen this year. It even resulted in massive blackouts and electrical system failures.

And while the game went off without too much trouble as temperatures rose in time for the game before falling again (and Aaron Rodgers won what will be his one and only title), the same can’t be said for electricity providers in the state.

This is because, with the global spotlight on Texas for the Super Bowl, the government took what happened very seriously and held an inquiry into what happened and made a series of sweeping recommendations to weather-proof the grid and electrical system, make it more resilient to cold and make sure such a catastrophe never happened again.

Among these recommendations were to winterize and otherwise insulate both the baseload generating plants but also the emerging renewables portion of the grid and all the systems that feed into it.

Eager to please, independent operators and industry participants, both large and small, who make up the vast majority of the Texas electrical system proceeded to… not do much of what was recommended

Wait. What?

That’s right, the recommendations were made, but not followed.

How dumb was that?

As it turns out, pretty dumb.

Why didn’t they do what was needed?

It’s hard to pick any one reason, but if I had to guess I would say it was because they would be weatherproofing the once in a hundred year storm and in Texas’s energy vs capacity system (more on that later), it is hard to recoup that type of expenditure.

And then?

Fast forward 10 years to last weekend and the reincarnation of Canada’s most annoying export, the Polar Vortex (again, sorry).

As the cold descended, power demand spiked, reaching close to 70 GW of demand, which ironically is pretty much the capacity as well. And, robust as it is in a normal operating environment, the electrical system in Texas buckled as the cold proved overwhelming.

Soon, close to 30 GW of electricity was offline and ERCOT, the system operator, was forced to implement rotating blackouts in order to prevent a complete and catastrophic system failure. And the rest, as they say, is history.

I have read that this is all due to renewables and their unreliability?

Well, what can I say to that except that it’s categorically untrue.

Of the 30 GW of power offline, a full 26 GW (or more) was offline because of failures in thermal or base load generation, not renewables. So no, it wasn’t because the “wind wasn’t blowing” or the “sun wasn’t shining”. It was because the thermal generation capacity (gas and nuclear primarily) wasn’t performing the way it was supposed to.

Ironically, even with a big chunk of wind being offline, the performance of wind power during this adverse event was in line with the modelling done by the system operator.

But why are people blaming wind?

They are blaming wind and renewables because they are trying to serve a political agenda.

As we all know, the argument about climate change and the growth of renewable power has become so partisan that it’s almost comical. Never mind that Texas, as red a state as you can get, leads the US in installing renewable power, if you can’t blame your problems on a Green New Deal that hasn’t happened and will likely never happen, what kind of right leaning politician are you.

This sentiment gets whipped up by uninformed media and soon you have people raging about pictures of turbines being de-iced by helicopters and focusing all their righteous rage on a sector that did what it was supposed to do according to data published by the system operator and acknowledged by the government (unless they are on Fox News).

Meanwhile the fossil fuel and thermal generators are celebrated as local heroes and held up as an example as to why the grid must for now and forever be beholden to King Coal, clean-burning natural gas and the splitting of atoms.

On the other side of the discussion are the pro-renewables people who are blaming, variously, the government of Texas and its “right wing GOP free market ideological stupor”, the lack of even more renewables, climate change, greedy power producers and fossil fuel industry lobbyists.

So who is right?

Well, each side is a little bit right and a little bit wrong.

Take a step back from the politics and it gets clearer.

It was and still is the failure of the thermal side to hold up their baseload requirements that is the true epicentre of this crisis. It’s called baseload for a reason.

On the other hand, wind turbines that freeze in the cold and don’t deliver the power they are expected to because they haven’t been winterized absolutely do not get a pass.

Neither in this instance is it simple enough to lay the blame at the feet of just the generators. It’s everyone across the value chain. It was a cascade of unpreparedness.

And while there were myriad problems with freezing of facilities at the generation and distribution end, many of the natural gas generation facilities were ready and available to put out power, they just had nothing to burn.

That’s because the whole infrastructure cracked under the freezing conditions, starting all the way back at the wellhead through pipeline gathering systems, storage and distribution. Everything froze. Production came to grinding halt in many locations.

Don’t believe me? Currently in Texas, there is 3.5 million barrels of oil per day of production shut in. That’s a lot. And a lot of those wells produce gas as well, not all of it is flared (of course this is due to lack of pipeline infrastructure – another day on that one!).

You know what else is a lot?

24 BCF/day of natural gas supply getting cut to 12 BCF. Texas is one of the largest producers of gas in North America. They produce 3 times what Canada does. And when half of that stops on a dime, it’s going to cause problems.

That’s what happened last week. Which meant that the remaining supply had to be rationalized. So delivery of gas had to be prioritized and it went to the utilities for heating first before the generators.

Cascading effect.

So, it was the fossil fuel network that bears the lion’s share of the blame for this, but really, when you pull the string, you can see it’s systemic.

It’s easy to say that installed wind capacity in Texas, which is high, should have been available, but it was never meant to be that way. There is a reason there is redundancy in any grid system. Still should have been prepared for the cold.

And it’s equally lazy to blame it on fossil fuels which are currently the backbone of baseload electrical generation across the entire planet. Still should have been prepared for the cold.

How about instead viewing it more as evidence of the danger of an over-reliance on any one type of energy source and an object lesson on what can happen when emergency and contingency planning doesn’t happen on a system-wide basis.

Why did Ted Cruz go to Mexico?

I don’t know. He’s Ted Cruz. A more important question is why was he allowed to come back?

Can the same thing happen in Alberta?

Sure, I guess.

Like Texas, our electrical system is pretty isolated with limited inter-ties.

As well, like Texas we have what is called an energy-only (vs capacity) electrical system which uses the prospect of rising price to attract investment, leaving it vulnerable to adverse events. But the similarities quickly run out. Unlike Texas, we know cold, so our system is designed to be resilient to it. Maybe extreme heat is a risk, but probably not – extreme heat to an Albertan is a Sunday in May to someone from the Houston. Hail and wind/storm damage is probably a bigger risk.

I am less concerned about the type of event that occurred in Texas happening here than I am in political ideology interfering with the functioning of our all-important electrical systems – on both sides of the spectrum.

These are all part of critical infrastructure that should be immune from over politicization.

The electrical grid is what separates us from being a caveman. It is essential to our way of life and it is fragile. And it is relatively new.

My mother was born in the Northwest Territories in 1933. There was no electricity, gas fired heat or running water where she lived. She used to freeze to the side of the house at night in winter. And now, a short 87 years later, an entire continent is dependent on this intricate web of wires, steam, blades, water, sun, gas, oil, rock, uranium and plugs to keep us alive, ranging from as far North as the Canadian territories to as far south as a snow covered beach in Galveston.

The “grid” supports civilization. Without it we mere humans are exposed for how fragile we are in the face of the elements no matter where we are, with all too often tragic circumstances such as we are witnessing in real time in Texas.

So when that system fails, it’s a societal fail and the reaction is visceral. Whether it’s California in the face of drought and wildfire or Texas and it’s Canadian winter visitor. We are truly always a week away from disaster.

It underscores how much we need to have a well regulated, interconnected and multi dimensional electrical system.

So it’s not enough to have all power coming from one source. We need the baseload, the wheeling power, the peaking power. The thermal and wind and fossil fuel and renewable.

This event isn’t an indictment of renewables. It isn’t an indictment of fossil fuels.

It’s an indictment of lack of preparedness and foresight. Of a system so wound up in ideology, things that should not have been missed were missed.

There is no politics in freezing.

So please stop grandstanding, learn what happened and fix it this time.

Stop with the asinine articles trying to assign blame to the other side of the political aisle or the other side of the climate debate. It’s counter-productive.

And for the rest of us smug people watching from afar, we should remember how dependent we are on all of the elements of the grid and the decisions that build and maintain it.

OK, enough about that. More questions!

Unrelated, but what’s up with Oil Prices?

Well, oil broke $60 this week and while it’s dropped a bit today, if I read the tea leaves, I think it is highly unlikely that Tom Brady is going to win another super bowl next year. Because from where I sit, I don’t know that oil is going to be trading below that price come SuperBowl 51 next year.

Sure there will be volatility and $55 is always closer than $65, but it just feels like we are in a fundamentally different market right now than we were even six months ago.

I could do a whole blog on this and maybe I should, but in the meantime let’s look at a few factors:

- OPEC and OPEC++++++ has been exceptionally successful in reining in production

- Global inventories are coming down faster than anyone thought

- US production temporarily shut in by the Texas freeze out will severely impact storage

- Demand is accelerating faster than anyone thought

- Vaccines are rolling out in an accelerated fashion, especially in key demand markets like the United States which will lead to increased re-openings of stressed economies and demand for oil

- Underinvestment in oil exploration and production was always going to lead to a pike in prices as supply dwindled

- Spring is around the corner for the Northern Hemisphere, which will increase energy demand

- Global GDP growth is projected to exceed 6% in 2021

- We haven’t even started flying yet

All of the above are extremely bullish for oil prices.

What does it mean for Canada?

Hmm, how shall I say this. What are the exact words I should use.

How about…

Buckle up.

There, I said it. It is hard to escape the feeling that we are in the consolidation phase of what is probably going to be the last oil super cycle and the first “all-in” energy super-cycle. You heard it here first.

And sticking to just the oil and gas industry instead of energy writ large – it is going to be big for Canada, mainly because we have the capacity and we have that behemoth market next door.

And anything that is big for Canada is going to be de facto huge for Alberta and Calgary.

You can see it in the M&A market. Companies are coming together to improve balance sheets. Others are doing strategic acquisitions to consolidate market share or geographic synergies. Still others are aggressively diversifying their commodity mix.

This is the typical precursor to much increased levels of activity.

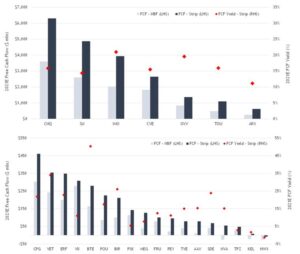

In the meantime, we have a gaggle of Canadian energy companies that have Free Cash Flow profiles that should make any self-respecting value investor giddy.

CNRL alone is expected to generate between $3.5 and $6 billion in FCF in 2021 depending on the price deck.

By comparison, that’s more FCF in one year than Tesla has generated – in its entire existence.

Tesla is currently trading at a P/E in excess of 1000. CNRL? 12 times. You tell me who is under or over valued.

Eventually, all that cash needs to go somewhere aside from bondholders, dividends and yacht purchases. Based on what I mentioned above regarding supply, demand and the undisputed laws of decline rates, eventually a good chunk of that money goes into the ground.

In the meantime, the Alberta government benefits from royalties tied to higher prices.

And it’s not just the oil market.

It’s natural gas as well which has stealthily been recovering since last year and where actual drilling activity to support LNG isn’t currently frowned upon.

I know it’s fun to dunk on Alberta these days and many banks and analysts have us lagging in 2021 in terms of economic growth, but I don’t buy it.

Oil and natural gas prices are up and will be hard to depress. We are seeing massive sector consolidation.

We are in the middle of an infrastructure boom.

And it feels like a commodity and resource supercycle is gathering steam.

Crack the ESG nut and the investment floodgates will open.

Advice to Jason Kenney?

Stay out of the way. Actually, there is one thing. Call up Blackrock. Tell them we want to buy 100 or so megatons worth of carbon credits from their fund. Net zero by 2050? How about net zero by spring. Bring on the dollars.

All kidding aside, Old school commodities are back. Have been for a while. if you’re still chasing tech in this market, you’re reading yesterday’s news. Energy, in all its forms – wind solar oil gas coal nuclear geothermal – is at the front of the pack with Canada leading the way.

The boom is back baby! It’s different this time and broader. And right here in Canada.

So should I go long Canadian Energy?

Yes. Absolutely. Were you not listening?