What an eventful week it has been in the markets and the energy world as we all collectively held our breath waiting on the Federal Reserve and the Bank of Canada to do the inevitable and bring interest rate Armageddon to the over-heated asset bubble housing and NFT markets of North America and cause a collective bout of stress-related acid reflux for over-levered consumers across the continent.

After all, inflation is the scourge of modern times and it is long past time to slay this demon once and for all. Except of course they didn’t. Both banks kicked that nasty can of creamed corn down the road and passed on doing the right thing. At least Federal Reserve Chair Jerome Powell had the stones to say multiple interest rate hikes were coming. Tiff Macklem? Crickets. It’s hard not to buy in to accusations of political interference when the actions of the central bank play so perfectly into the agenda and platform of the governing party, but I will avoid that for now. Maybe they are just being extra special crunchy careful.

So, inflation, interest rates and all that jazz. Moving markets up and down and stressing out investors to no end. And, of course, impacting energy markets. Which are figuratively and literally on fire. And, after all, what this blog is mostly about.

So, in that context, I thought it would be a good time to revisit where we are at, what new developments have occurred, how current events are going to impact our energy world going forward and what, if anything we might expect. In that ever-brief period since January 14. When I wrote my fearless forecast that covered off most of these topics in some shape or form.

In no particular order…

Russia, Russia, Russia and the Ukraine Gambit

The bizarre military provocation that Russia is currently engaging in in the Ukraine is as destabilizing as Vlad the Bad was hoping it would be. Troops amassed at the border, arbitrary demands, governments in waiting – he is acting 100% the part of the mad despot looking to expand territory. Meanwhile NATO and the United States are stuck in their response. They need to protect Ukraine and their Eastern flank, but no one wants a war. Least of all Russia. A shooting war will only lead to bad outcomes and could escalate very rapidly into something much greater. The choice is to call Russia’s bluff on a situation they created out of thin air or negotiate a face-saving diplomatic standdown. Neither outcome is ideal and as the president of Ukraine said, he doesn’t think Biden and Putin should be deciding Ukraine’s fate.

In addition to territorial integrity and land bridges to other illegally occupied areas (Crimea), the Ukraine Gambit is also all about energy. Russia desperately wants the completed Nord Stream 2 gas pipeline to Europe to be allowed to come online so it can generate massively needed foreign exchange and complete its stranglehold on a European energy market which, to be honest, desperately needs Russian gas. This may in fact be all Putin wants.

Meanwhile, the uncertainty is massively disruptive to already stressed European market and global energy markets as we mull the range of possibilities ranging from all-out war to financial sanctions on rich Russians (best strategy), or energy (oil and gas) export embargoes (impossible to implement and, given the energy world, self-harming). At this stage, the premium to energy prices from the Ukraine Gambit seems to be modest, instead manifesting itself as much higher volatility.

In the meantime, Canada has pledged robust Twitter support and hopes and prayers, so we’ve done our part.

Middle East Muddle

Not wanting to be left out of the whole “let’s destabilize the world during Omicron” fad, the last couple of weeks have seen some stepped up volatility in the Middle East.

It all started with Houthi rebels in Yemen lobbing some lawn darts at some industrial sites in the UAE on separate days, resulting in a few deaths. Soon after, another attack, this time aimed at Saudi Arabia industrial targets, also resulted in a couple of deaths. This was quickly followed up Saudi air strikes that the Saudis denied. All this in retaliation for other air strikes that killed more than 80 in Yemen.

This volatile and confusing situation continues to evolve, but is also adding a minor risk premium to crude prices given the importance of the region to OPEC production, particularly with Vlad doing his Ukrainian dance.

While technically not in the Middle East, Libya is determined not to be outdone and continues to impact the oil market. Libya recently saw a blockade lifted allowing production to increase, but a delayed election is sure to result in continued instability making the country an unreliable producer notwithstanding the eagerness of anti-oilsands majors like Total to lose a bunch of money there. Sudan, Not to be outdone in the M

Iran Nuclear (done?) Deal

From what I have been reading, it appears that the Iranian nuclear deal, which was so famously cast aside by Donald Trump, is back in business. At least the negotiators appear to have made huge progress. So much so that they have left the safe confines of Vienna to go back to their respective countries (why would you do that?) and pitch the various compromises to their political masters.

Nothing says done deal to me more than simply needing the approval of politicians. This should be done by next Friday.

In all seriousness, if this were to be settled that is a good thing.

On the energy market front, this doesn’t seem to be having much effect, although the pundit class seems to think that the removal of sanctions/embargoes against Iranian oil will somehow solve the United States’ gas price problem.

It won’t, of course. Never mind that Iran is subject to the OPEC quotas, they have also been producing oil all this time while under sanctions and if they want to suddenly start pushing that oil into the market, their number one not so clandestine oil buyer (China), will have to agree to it, and maybe find an alternative source.

At this stage, it is unlikely that there will be that many net new Iranian barrels to contend with, and the market understands that.

Central Banks

Chickens. That’s all I have to say. Is the economic recovery really that fragile that it can’t withstand a 25 basis point increase in rates? Look, I understand that that is a 100% increase in borrowing costs but come on.

Inflation continues to rage unabated. Asset values are trapped in a cap rate bubble of unprecedented proportion. The Canadian housing sector, that generates minimal economic value add in the form of exports, employment, cash flow and productivity is north of 10% of our GDP, maybe greater than the energy sector (ahem), spurred along by easy money that allows scarcity to create artificial value. The crash, when it comes, because it will, will be made harsher by central bank hesitancy. Ask yourself this question. If rates are going up by 150 basis points, what is a greater shock to the market – 6 increases over 12 months or one big one the day after Christmas.

I get the “impact of Omicron is still being assessed” but last time I checked, US Q4 GDP was through the roof, employment was at record levels, Canadian GDP was actually positive, air travel was continuing unabated and Europe was coming out of whatever lockdowns remained, with Denmark pretty much press-releasing “Hey everyone, we’re all done with COVID, have a Tuborg on me.”

Look, the longer rates stay historically an unnecessarily low, the better it is for oil and gas and the commodity trade. That’s good for Alberta and other resource rich areas, and I’m down for that and so is my energy leaning portfolio, but kicking this particular can down the road serves very little purpose.

Sector Rotation

This is more of an observation than anything, and ties into the Central Bank and inflation diatribe above. It isn’t something that just happened this week, it has obviously been building, but the actions of the central banks have really brought it home. That is, the longer that inflation runs unchecked, the better it is going to be for the value side of the investing world and real asset type businesses and the worse it is going to be for businesses that require cheap capital and hopes and dreams economic growth.

Put another way, with super low rates and low inflation, the risk-free rate and thus cost of capital for businesses that rely on the future for cash flows is super low so discounting those mythical cash flows back into present day dollars yields absurd valuations. Add a few points to the risk-free rate, or add in some good old inflation and those discount rates spike and flushes those future values into the toilet, taking the stocks of those high flyers with them.

Don’t believe me? Believe the market. One need only look at the ARK Innovation ETF which exists to invest in the high growth, tech focused, inflation averse companies that are going to transform society. How are they doing? Well from the looks of it, not so hot. Since October 2021, they are down more than 50%. Every holding is down. Their best performer is Tesla, only down around 20%. The only positive return they had in the portfolio was their cash balance, which is sure to be stressed as redemptions accelerate.

In the meantime, energy focused funds, that invest in companies that are producing actual cash flow, today, are up on average 50% to 80%, ETFs or otherwise Some funds are up more than 200%.

What does this mean? Is it short term? Secular? Depends. But in times of high inflation, real asset businesses tend to outperform, value is better than growth and cash flow trumps pipedreams.

Well that’s the end of my observations for the week. At least as they relate to energy prices.

We are testing new highs with the price of oil that could be problematic for the broader economy.

These elevated prices are driving inflation, forcing central banks’ hands as it regards interest rate policy and this will have knock-on effects through the economy in the form of higher borrowing costs, asset devaluations, deleveraging, housing, food and energy affordability and significant impacts on personal wealth through investment.

Add in the ongoing gong show that is COVID, political opportunism, extreme partisanship and rampant populism combined with low information silo dwellers and we are set up for an extremely volatile year.

That’s my guess at least. We may even see the Cincinnati Bengals in the Super Bowl. Which would just be the weird icing on the cake, not to mention devastating to the Buffalo Bill fan base.

Trucknuts for Freedom

Speaking of populist opportunism, Canada’s freedumb convoy is probably not going to move the oil price, but this is happening this week so I feel I need to comment on it.

Let me say the following out of the gate. I get how it all started. And I do not agree with the vaccine mandates for cross-border trucking as they have been implemented by Canada and the United States. They were implemented with typically limited regard for knock-on effects to people and industries. Par for the course for the Trudeau government and an emerging trend with the Biden boys.

The transportation, supply chain and logistics sectors are all essential industries. They kept the world functioning while COVID ran rampant through society, just like the health care sector kept people alive and the education sector kept kids learning and the M&A sector kept transactions moving (shameless self-promotion). And like all these other sectors, when vaccines became available, the people that make the industry tick got vaccinated, for the most part.

Now here we are two years in and the demographic for truck drivers, shippers, warehouse workers, health care workers, teachers and finance bros in Canada are all approximately 85% to 90% vaccinated. Great!

But there are still holdouts. And border restrictions. Corporate vaccine mandates control a lot, but there are independent contractors who aren’t under such requirements and governments, for better or worse, have determined that as COVID comes to an end, the essential tag that truckers have long held, as have other workers, needs to come to an end.

So back in November, Canada informed the industry that as of January 2022, normal quarantine rules THAT EVERYONE ELSE IS SUBJECT TO, will apply for the cross-border trucking industry. At the same time, the United States followed suit with similar rules and timeframe (so did Mexico, but let’s not confuse things by demonstrating that this is happening everywhere).

This meant that, as of January 15 (or 22nd for the US) 2022, if you wanted to be a cross-border trucker and didn’t want to quarantine every time you crossed the border (with or without cargo), you needed to be vaccinated.

Who does this affect? Surprisingly few. Sure some companies that didn’t have robust vaccination rules already or failed to plan lost drivers. A number of independent contractors who either chose not get vaccinated or didn’t have the time now had some hard choices to make. But the reality is that the problem just wasn’t going to be as severe as many thought. In fact, one might say that with a 47% vax rate for US truckers compared to 90% in Canada there might be an actual market opportunity for vaccinated Canadian truckers to dominate the cross-border transportation market! But that’s just the finance guy talking.

Anyway, the new mandate didn’t sit well with a bunch of opportunists and charlatans who seized on the announcement and argued that this was going to crush the economic livelihood of an entire industry, fan the flames of inflation and lead to food shortages so severe it would make the former Soviet Union look like a cornucopia of plenty.

While there is no doubting that the shortage of truckers in general has exacerbated COVID-stressed supply chains and contributed to inflation, anecdotal evidence of empty shelves in select grocery stores across Canada is not evidence of widespread food shortages due to vaccine mandates announced months in advance that provided plenty of opportunity to plan for contingencies.

It is much more plausible that storms in BC that wiped out highways and rail mere months ago are a bigger contributor to the supposed empty shelf conundrum, as well as out of control Omicron infections on both sides of the border, not only among the trucking population but amongst producers, processors, warehousers and distributors of all these products. How can I say this with confidence? Probably because I have been reliably informed by people in these industries that this is indeed the case.

And it’s a logic pretzel to figure out what these protests are actually trying to change. The mandate is that you can’t cross from the US into Canada without being vaccinated. The US mandate is that you can’t cross into the US without being vaccinated. So as near as I can figure, the Canadian protestors are mad that unvaccinated truckers can’t come back to Canada from a country whose sovereign government won’t allow them to enter. So who is the beef with anyway? Canada? The US? Trudeau? Biden? Pfizer?

This inconsistency is I guess why the entire thing has been coopted and politicized by the generic anti-vax, anti-woke, anti-COVID, anti-Trudeau movement and dressed up with flags, patriotism and the word Freedom. Who can argue with Freedom, right? Freedom from what, who knows. Who really cares as long as you can burn it all down.

It is also why such intellectual luminaries as Mad Max Bernier of the People’s Party, Joe Rogan, Donald Trump Jr. and Theo Fleury are on the case. I mean Theo Fleury was trotted out on Fox News where he said 50,000 trucks and 1.4 million people were descending on Ottawa in such an uncontested and shameless piece of information that was both breathtaking in its exaggeration and preposterous in that it sat there unchallenged.

For perspective, there are only about 600,000 trucks – all uses – in Canada.

So, a beef with vaccine mandates affecting a portion of the 10% of truckers not yet vaccinated has now transmogrified into a rally for all the various groups angered by mandates, vaccines, perceived slights against various industries, general hatred for government and specific hatred for Justin Trudeau. As with any protest, mixed into that are rabble-rousers, trouble-makers, inciters and hate-stirrers.

Oh, and instead of a request to drop the cross-border vaccine mandate we know have some fake legal document calling on the unelected governor general to oust the duly elected Federal government, repeal all COVD restrictions (most of which are provincial) and replace the government with someone more compliant. It’s kinda like asking a vice president to toss out the votes of electors in a presidential election.

The original point of the protest has been coopted, warped, exploited and tossed in the trash. Which is a shame. Because now it’s just a side-show.

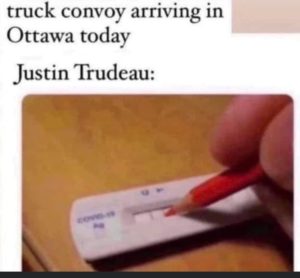

And what are our duly elected representatives doing, you might ask?

First off we learned that NDP Leader Jagmeet Singh’s brother in law contributed $13,000 to the Go Fund Me campaign in support of the rally. Oopsie Poopsie!

Then, not to be left out, at the 11th hour, the Conservative Party of Canada decided to throw its hat in the ring with carefully worded statements supporting “truckers” and truckers only.

Finally, Trudumb (yeah you) decided to weigh in and belittle citizens of his country calling them fringe zealots that don’t represent Canada, were misogynists, racists etc. Wow. That’s real leadership right there.

Sorry bub – your country. Good. Bad. Right. Wrong. Leave the moral judgement in your pocket. Get out and solve the problem.

Anyway, match lit!

Ultimately, it remains to be seen how many show, or how much trouble they get into. Latest media says less than a thousand vehicles in total, undetermined amount of people, but a far cry from the hype. Of course that can change, I mean everyone in the country should visit the nation’s capital at least once in their life, why not tomorrow?

As an aside, I saw an interesting post that in downtown Ottawa, there are a lot of one way streets and a startling lack of bathroom facilities. With that many vehicles and that many people, this could get ugly in a hurry, and not for the reasons most pundits think.

Look, I know the preceding is going to piss a bunch of people off, but so be it. I’m as sick of COVID restrictions and the pandemic as the next guy. It has affected me and my family and my friends and my business, but we have managed to adapt without comparing restaurant vaccine passports to Nazi Germany.

I firmly believe everyone is free to protest and voice their opinion. Have at ‘er. I have just as equal a right not to share that opinion. But we need to stop shoving it in each other’s faces.

Anyway, back to the original point.

Do I agree with these mandates? No. I think they are stupid and unnecessary and inflammatory.

Do I agree with what the convoy has become? No. See the preceding paragraph(s).