Well there you have it. The election is finally over. What was 28 days of full-on flinging of mud, rage and other nasty stuff has, in typical Canadian fashion, rolled over into the smooth and peaceful transfer of power from the Rachel Notley NDP to our new set of overlords, the United Conservative Party lead by Jason Kenney.

With the election over I can finally catch up on my sleep and with the all-consuming rage messaging toned down I no longer find myself curled up in the corner hiding from the world at large.

And in the interests of acknowledging that this is a holiday weekend, I’m not going to take up much of your time this week, instead I’m just going to do a quick flyover and debrief on the election and results and, given the time, highlight a couple of things we should pay attention to in the coming weeks and months. I might even close out with a list. I am feeling listy today.

Well election night was pretty exciting for a lot of people, in particular the United Conservative Party and its many Jasons (little known fact, there were five of them elected – this might be a full column at some later date depending on how Cabinet shakes out – thanks to another Jason for pointing this out BTW)

At any rate, my prediction of 50 UCP, 33 NDP, 3 Alberta Party and 1 Liberal didn’t really carry the day did it, although my geographical breakdown held up. As of today, with some votes still to be counted, we are at 63 UCP and 24 NDP. A massive majority, but still with a stronger opposition than was typical during the past conservative dynasty, which is a good thing because holding governments to account is always desirable.

I had considered rolling the dice on a bigger UCP win in my predictions but the reality is that I didn’t anticipate the evisceration of all the small parties, at least in terms of seats. Ironically, if Alberta had proportional representation, my predictions would have been very close to reality and I’m sure the smaller parties and their supporters are hand wringing that we don’t have proportional representation. Of course, if we had proportional representation, the NDP would have never won in 2015 and the world would be fundamentally different. And, if we had proportional representation, the five Jasons would have official party status. Think about that for a minute!

So there you have it. A conservative majority, stronger than anticipated. A plurality of the votes. 70% participation. The highest since 1982. This is a very clear endorsement of the UCP platform and repudiation of the NDP vision.

So congratulations and good luck to Jason Kenney and the UCP team and all the MLAs elected this past Tuesday, including my own MLA who was given a strong vote of confidence for a second term.

That’s really all that needs to be said as the new government gets down to business, because there is a lot of work to be done. The economy needs a lot of help and the problems we have are long term in nature and won’t be solved with the wave of a wand (except of course TransMountain but that’s for later).

I also think that it is appropriate to take some guidance from the leaders of the respective parties and take a conciliatory tone. The election is over. There is nothing productive to be gained from continuing to refight it at this point in time.

Especially given how nasty and visceral this campaign was. In particular on social media. I wonder if maybe we should all take a break from our Twitter and Facebook rage machines to recharge and reorient ourselves, go outside and get a breath of fresh air. Unless of course those are the platforms you read the blog off of, well because. The vitriolic nature of this campaign was something I have never seen in elections since I lived in Quebec and we were debating separatism. Even then the platforms for rage and hate weren’t as ubiquitous.

Some of the things people said on Twitter and Facebook were beyond comprehension but I guess when you can hide behind a stage name all is on the table.

And don’t talk to me about the “Americanization” of politics and try to point the fingers at Trump for the coarseness of our discourse. We made the decision to be this way, it has always been there, we’re just able to see it now.

What we do have is a polarized electorate and polarization breeds contempt.

I shudder to think how the federal election is going to unfold where the polarization is equally ascendant.

So, what’s next for the Kenney government?

Well, before I leave this subject in the rearview mirror, a quick look at what’s ahead for the UCP government, because the next few weeks will be quite important.

First order of business is to appoint a Cabinet. This has been promised by April 30 when the new government gets sworn in. A lot of eyes will be on key portfolios such as energy, economic diversification, environment, health care and education. There is a lot of talent to choose from here and how the appointments play out will say a lot about the tone of the government going forward.

My own view is that the UCP will stay true to its main points during the campaign and focus heavily on pipelines and jobs and avoid messing around too much in the other departments, but I have been wrong many times. That said, the economy is the number one issue they campaigned on, the policy platform is all economy all the time, so why would things be different.

Once cabinet is selected, the legislature will be called back the third week of May, which is when you can expect to see all the major bills the UCP campaigned on being introduced including the Carbon Tax repeal and the infamous “turn off the taps” legislation.

A few final comments.

A lot has been made of the fact that Jason Kenney was highly combative as it regards BC and the Federal Liberals during the campaign yet was conciliatory and diplomatic in the first few days post-election and is being criticized for this by both supporters and opponents. To this I say calm down. There has been no sudden about face on positions or policy, this is just how the system works. I’m not sure what people actually expected him to do? I’m totally fine with the UCP campaigning from the top ropes and governing from the mat.

It is especially interesting because two gauntlets were tossed the day of and after the election. First, the John Horgan NDP government in BC announced their support for C48, the tanker ban, just before polls closed on Tuesday. Then, the day after the election and presumably revealed during the congratulatory phone call from Trudeau to Kenney, we learned that the decision on the TransMountain Expansion has been delayed for another 4 weeks to June 18th. Because… stop me if you’ve heard this one before, more consultation was needed. Whatever.

In the face of these developments, you’d expect some pretty rabid reaction from Jason Kenney, but he kept his cool. Look, he has a mandate to fight back, but he does get to control the timing of what, when and how he executes that mandate. Cut him some slack.

And finally, for the naysayers who have held that a change of government wouldn’t have any impact on investor perception of Alberta I say stop. Just stop. In the three days since the results were announced I have had regular correspondence with investors and funds from other jurisdictions expressing renewed interest in Alberta. They are aware of the change of government and they view it in a decidedly positive light.

Unless someone does something really stupid or egregious, I’m now officially taking a break from politics.

Time to get back to work I guess.

I promised a list so here it comes. I call it a bunch of things I can now start paying attention to and that may one day be the subject of an entire blog now that this election is over.

US LNG is on fire.

Not literally, but there is a lot of activity. The U.S. Federal Energy Regulatory Commission (FERC) approved on Thursday two liquefied natural gas (LNG) projects that will add to the growing U.S. export capacity of LNG.

FERC approved the project for the Driftwood LNG export terminal and associated pipeline on the west bank of the Calcasieu River, south of Lake Charles, Louisiana, proposed by Tellurian, and the Port Arthur LNG facility in Texas planned by Sempra Energy. Another 10 proposed LNG export projects are pending approval.

The United States is expected to double its LNG export capacity by the end of 2019 and continue to grow for years to come.

Is anyone in Canada paying attention to this?

US Pipelines are on fire (sense a theme here?)

Not literally, but there is a lot of activity. Aside from the well documented number of projects approved and under construction connecting Permian oil and associated gas to the Gulf Coast, US President Donald Trump just announced sweeping new energy infrastructure powers to fast track Northeast natural gas pipelines and re-issued the presidential permit for Keystone XL.

Is anyone in Canada paying attention to this?

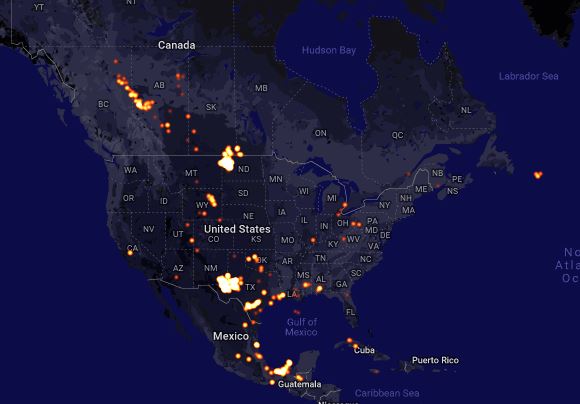

The Permian and the Bakken are literally on fire!

OK, this one is true. Flaring of gas is at an all-time high in the US as a lack of takeaway capacity (see pipelines above) is leading to massive glut of natural gas from increasingly gassy LTO wells. Can’t imagine how this is good for the environment although I suppose that CO2 from flaring is better than methane leakage from unattended producing wells, but really….

It is estimated that 1.5 BCF per day of gas is burned in Texas alone and, it’s visible from space! And illegal over a certain amount, but hey, gotta keep drilling.

Remember about a decade ago when we had a shortage of natural gas and everyone was building facilities to import LNG into the United States? Not so much anymore. What an immense waste of a resource. Hey, and natural gas inventories closed withdrawal season at their lowest levels since 2014. All good.

The price of oil is on fire!

It’s on a tear, up more than 30% for the year. OPEC+ has managed OECD inventories back down to the 5 year average, Saudi Arabia is aggressively intervening in the market and no one really has any spare capacity, which means that new supply needs to be developed.

Yet everyone keeps saying that the Alberta energy industry doesn’t stand a chance unless the price of oil goes back to $100. Really. Do you know how many Alberta and Saskatchewan based oil companies can make money at $60 a barrel with their existing production? Hint, it’s all of them. If only we had one of those pipeline thingies we could grow production and jobs too.

And how many Permian producers make money at $60 oil? Not as many. To be truthful, just a handful. Notwithstanding that, activity levels in the US continue to outperform.

The price of heavy oil is on fire!

Who would have thought that nasty, thick, heavy oil would be in such demand. What with all the never-ending talk about light tight oil and US energy independence a funny thing happened. Venezuela collapsed. Mexico is underinvested. Crude slates in demand at refineries like medium and heavy grades. And as a result there is massive demand for heavy oil across the globe. Urals oil is flowing into Europe. Maya oil into the Gulf Coast. Western Canada heavy oil is finding its way to the Gulf Coast by any means possible – rail, barge, the south end of the Keystone XL pipeline (the part that was built without protest 5 years ago). Demand in China for heavy oil is increasing, and they will take it from anywhere, even sanctioned countries if others don’t want to supply them.

The Canadian Oil Patch is not on fire!

Yet.

But it’s coming. For some of the reasons enumerated above. The global market demands it. The pendulum is swinging back. Not even Trudeau can stop it.

Jason Kenney, you may have a lot of work to do and it’s going to be as hard a task as any you have undertaken, but your timing couldn’t possibly be any better to ride this wave.

Prices as at April 12 (April 5), 2019

- The price of oil was up this week on modest production gains and supply concerns.

- Storage posted an increase

- Production was up

- The rig count in the US was up

- Injections to storage were flat with expectations for gas. The market was unmoved

- WTI Crude: $63.98 ($63,78)

- Western Canada Select: $53.38 ($55.36)

- AECO Spot *: $0.60 ($1.29)

- NYMEX Gas: $2.488 ($2.648)

- US/Canadian Dollar: $0.7484 ($0.7481)

Highlights

- As at April 12, 2019, US crude oil supplies were at 455.2 million barrels, an decrease of 1.5 million barrels from the previous week and 27.6 million barrels above last year.

- The number of days oil supply in storage is 28.5 compared to 25.3 last year at this time.

- Production was down for the week at 12.100 million barrels per day. Production last year at the same time was 10.540 million barrels per day.

- Imports fell from 6.599 million barrels to 5.992 million barrels per day compared to 7.930 million barrels per day last year.

- Exports from the US rose to 2.401 million barrels per day from 2.349 million barrels per day last week compared to 1.749 million barrels per day a year ago

- Canadian exports to the US were 3.396 million barrels a day, down from 3.424

- Refinery inputs rose during the during the week to 16.100 million barrels per day

- As at April 12, 2019, US natural gas in storage was 1.247 billion cubic feet (Bcf), which is about 25% lower than the 5-year average and about 4% less than last year’s level, following an implied net injection of 92 Bcf during the report week

- Overall U.S. natural gas consumption was flat during the report week

- Production for the week was up 1%. Imports from Canada increased 2% from the week before. Exports to Mexico decreased 20% because of pipeline maintenance

- LNG exports totaled 28.4 Bcf

- As of April 18, 2019, the Canadian rig count was flat at 66 (AB – 48; BC – 15; SK – 2; MB – 0; Other – 1. Rig count for the same period last year was 90.

- US Onshore Oil rig count at April 18, 2019 is at 825, down 8 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was down 2 at 187.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 1 at 23.

- Offshore peak rig count at January 1, 2015 was 55

US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 68%/32%

Trump Watch: Mueller report. Lots of interesting stuff in there…