This is it folks.

You may not know it, but this is what you have all been waiting for since I started to mail it in as of early December. You see, I have a plan when I do all those Christmas blogs – movie ratings, naughty and nice lists, poems. All part of my super secret plan to observe the world, come up for air and determine for you, my dear readers, what exactly the heck is going to happen in the upcoming year.

This means that all those investment decisions, life-changing real estate purchases and Bitcoin financed NFT buys that you have put on hold while awaiting some kind of proclamation from on high can now be reactivated, because below you will find the one, the only prescient source of future knowledge you will need: the annual Stormont Capital Fearless Forecast.

That’s right, it’s not just any forecast. It’s a FEARLESS one.

So, you may ask yourself, what does fearless mean to the little people? Well, it means it is bold, brash, unconventional and will contain no less than six humdingers. Some of which have as much chance of occurring as a Trump-Pence 2024 ticket, but some, well they have a “Trudeau does something economically inept” certainty to them.

Still others have the inevitability of a Liberal government in Ontario, which may or may not be one of my predictions for this year. Sorry if that offends you, I can only say what the magic 8-ball, umm crystal ball, tells me, not necessarily what I prefer. Rest of Canada, you have been warned. Plan accordingly.

So come on folks and step right up, step right up and let me tell you about the prognostications and guessifications that will provide amplification and electrification to your portfolios. The stock picks and the macro directions that will set you on the path to eternal riches and immortal salvation.

The fever dreams, the visions, the words that will allow you to rise above the petty, malignant grind of your humdrum daily lives, secure in the knowledge that up is up, down is down and whatever is in the squishy middle is indeed edible.

And if I am wrong, so what! Right?

It’s not like anyone actually risks any money on the basis of these forecasts. Right? Like seriously folks. Don’t do that.

And if I may say so myself, compared to prior years, this may be the Greatest Forecast Ever AssembledTM

Even better than last year where at this time I predicted close to the exact election result in Canada, the demise of the KXL Pipeline and actually got my natural gas price prediction right (this is akin to a forecasting miracle) even if I whiffed on a few important categories that may have mattered to some people, like, ahem, stock picks, where my genius 38% return underperformed my benchmark by… (checks spreadsheet) umm, 42%. Like you’ve never missed, right?

With that warning, follow along. If you dare.

Broad Themes

I usually start with political predictions but I think that while it is fun to watch the politics and opine on what this or that individual or party is going to do, if I’m really going to be committed to this forecast, I need to pick my “broad themes” properly so that I can refer to them as often as possible in the forecast because I think they underpin a lot of what will be driving the political and market discussion over the coming year.

I have three, and they aren’t surprising, because they are in the news. All. The. Time. But they matter and if you are going to take anything from this forecast, plan your life around these three critical themes.

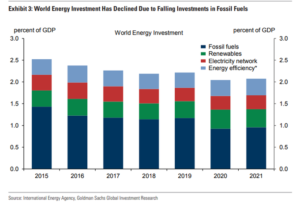

- Energy Security vs Energy Transition – lack of investment leads to scarcity and causes inflation

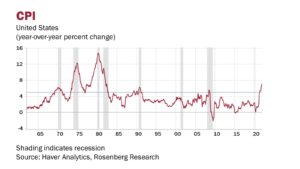

- The rising I’s. Inflation and interest rates – high inflation precedes recession

- Enough Already aka Pandemic Exhaustion – WTAF is that store?

Each of these will in some way inform and influence all that follows

Politics and Stuff

Last year civil unrest and the aftermath of the US Presidential election was my pick to be front and centre on the North American and global front for the course of the year. Which of course was super easy.

This year will start off not so different as the United States heads into the all-important mid-term elections where it is accepted wisdom that a newly elected presidential ticket and party will get their asses handed to them by a feisty and impatient electorate. And if it seems like the US is always in election-mode, it’s because they are. It’s uniquely exhausting, like a pandemic.

While Earnest Joe Biden has done his best to build back better and be bafflingly boring after four years of a chaotic Trump administration, the reality is that while his personal electoral win was a landslide by any objective measure, the legislative majority was much more tenuous. The result is that he has been stymied in getting his full agenda implemented and the January 6th Commission and focus on insurrection, while critically important, is not something that engages the public at large without actual indictments. Investigations behind closed doors that don’t yield results are not the headline and initiative grabbers that the Democrats are needing. Legislative wins are. Biden doesn’t have enough. And it will cost him. Especially as he takes the blame for an economy buffeted by – in order – inflation, rising interest rates, energy insecurity and pandemic exhaustion. It may not be his doing or fault, but he’s the boss.

So my first prediction, which will handily not need to be judged until November, is that the balance of power will tilt the GOP way in the Senate, but not the House, meaning 2023 and 2024 will see either horse-trading or nothing of significance getting done in the US, sidelining much of the Biden agenda, in particular those priorities that relate to more left-leaning causes and, importantly, the environment.

As per above, the main drivers of this win are a perception that Joe didn’t do enough to beat back the pandemic and that his policies are creating pocketbook issues for Americans amidst runaway inflation.

This shift of power and what it entails will depend a lot on what happens with Trumpism, such as it is. For the past year, we have had relative quiet without the flaming dumpster fire effect of Donald Trump’s presence on social media platforms such as Parler, Twitter, Facebook, YouTube, Tiktok, SnapChat, Instagram, Shopify, MySpace and the like. Unproductive Trumpism (the greed, the insults, the rage), much like a cockroach, will not die easily, but die it will. Although a threatened 2024 Presidential run is still very much in play for Donald Trump, but I don’t buy it. There is too much else going on in Trumpland.

Top of the list are two indictments against Trump and his companies. One in Georgia and one in New York. At least one of these will go forward and I think the distraction will prove too much. A guilty verdict in either disqualifies him, an extended trial will lead to the Republican Party re-evaluating whether they need to continue to hitch their wagon to an increasingly rabid horse. A decisive win in 2022 for the GOP will embolden them to move on from Trump, while, ironically, a decisive loss might also accelerate the ditching of Trump even more.

Also, Hilary doesn’t run in 2024 either.

It is still entirely possible that a third party emerges in the US. There isn’t much real unity on the GOP side, but the desire appears to be to maintain the traditional party even if they can’t get rid of the Q-Anon whackadoodles.

Here in Canada, we have had our Federal Election about nothing with nothing results. The Liberals have interpreted their win as a mandate to implement their entire platform as if they are a strong majority government and right now the opposition is in such a state of disarray that they are pretty much free to do what they want.

That said, pandemic exhaustion has definitely set in. The people are restless. Housing prices are out of control across major markets, productivity is falling, the economy is underperforming, inflation is on the march and for the first time in generations, housing, the most unproductive part of the economy, is a larger component of GDP than manufacturing, propped up by cheap money and easy credit.

The Liberal government has absolutely no plan to deal with any of the preceding and is unlikely to in its present incarnation. This is a major problem because when interest rates start to increase, as they must and will, the marginal homebuyer/borrower is going to find themselves out of luck in a hurry with disastrous consequences for the country economically and politically for the government.

Housing, inflation and energy are the governing Liberals Achilles Heel. The opposition needs to wake up and use them. The Liberals hubris-driven obsession about the environment above all else will prove their electoral undoing as regular Canadians see their prospects get sucked underwater in an inflationary, rising interest rate and wage stagnation .

I’m not ready to make a definitive call, but I wouldn’t be surprised to see an election in Canada this year. I think Trudeau is out as leader regardless, he is increasingly irrelevant. Jagmeet Singh is on his last legs and Erin O’Toole is clearly flailing, yo-yo’ing between shameless pandering to his lunatic fringe and cozying up to the PC 905 crew. It would not surprise me to see political whack-a-mole Peter Mackay re-emerge as a CPC saviour.

Canadian politics is due for a reset. We can’t afford this cast of muppets and clowns anymore. In any party.

Globally, 2022 should see a return to and continuation of some regional tensions.

The Iran crisis, which has been ongoing for more than 40 years will continue to percolate. A robust nuclear program is their goal and they are well on their way. They will continue to drag out the revised JCPOA negotiations as their nuclear leverage increases. The only way to contain Iran is to support Saudi Arabia with weapons so the Middle East is a “pick your poison” region as always. Rising inflation and energy costs in Iran are causing domestic issues. This is worth following. Biden may jump into a deal if energy prices persist at high levels if only to increase “official” supply.

China is a belligerent problem. Clearly their goal is to challenge the US for dominance in the Pacific, Africa and South America. Donald Trump misplayed this by being so inwardly focused. Biden risks exacerbating this by being distracted by Russia and Iran. Biden will need to build a much broader coalition to deflect China’s economic might and thwart some of its more malign ambitions. Hong Kong is gone. Taiwan is for sure next, but that’s probably a 2023 priority for the CCP who are going to spend 2022 deleveraging and then re-energizing their economy.

Russia is a big deal to the United States and Europe and a lesser deal to other countries around the world. Russia appears to have grand aspirations of territorial or influence expansion, but they are a fading power. Putin has the ambition, but it doesn’t seem to be shared by anyone else in the country. The massing of troops and threatening of Ukraine are worrisome and the United States needs to act much more forcefully to eliminate that threat, but even Putin isn’t crazy enough to invade. He wants his gas pipeline open so he can own European energy insecurity even more than he does. The gambit is influence and fortune, not hegemony.

South America, including Venezuela which is in its 1229th year of economic stagnation seem to be on a bit of a razor’s edge with inflation accelerating across the continent. Brazil and Argentina aren’t as stable as they were just a few short years ago. There is a strong potential for internal conflicts.

Lastly, Africa, whose countries comprised more than half of the top 10 humanitarian crises list for yet another year will continue to be a pawn for the major powers.

Energy and Environment

On the energy and environment front, 2022 is going to be a year of transition but not of the variety we typically talk about.

This year the story will be dominated by energy (in)security and energy pricing. Mostly of the rising variety.

Half the world has been busy pursuing the renewable energy transition, hoping to achieve the impossible and meet unenforceable and unachievable net-zero goals. The result has been a massive investments in solar and wind power to raise their share of the energy pie by a few measly percentage points, while completely ignoring the backup systems needed to support the grid when the renewables aren’t renewing.

The entirely predictable result of the human tendency to pursue one track at all costs has been a breakdown in the energy security compact, with prices rising in almost exponential pandemic fashion across the globe and transitions running into the harsh reality of winter, scarcity, inflation, human nature, development aspirations, lack of investment, intermittency, realpolitik and cost.

It is impossible to transition to a renewable, net zero grid without ensuring affordable and secure energy supplies for the consumer, ranging from the impoverished family burning twigs in a tent in Africa to boil untreated water to the fertilizer manufacturer in the Gulf Coast. The global energy system is like a living and breathing entity with each part inter and intra-dependent. Late 2021 in Europe is just a prelude to the path we never wanted to be on and the more energy prices spike and service is interrupted the more users will search for a scapegoat. And in the 2022, it feels like that scapegoat might be the entirety of an all too rapid attempted transition to net-zero.

Energy prices broadly are at their highest since 2014. The price of solar and wind can’t fall much further. Inflation is rampant. The cost of capital is about to start increasing dramatically to offset inflation.

Something has to break. I don’t think it’s the oil and gas industry.

While the LTO train managed to recover some ground in 2021, they will require sustained price increases to overcome regulatory and financial hurdles to get back on a growth curve. A global lack of investment has seen supply get squeezed. OPEC can’t meet their quotas, drilling productivity in the Middle East is in the tank. Mexico is so concerned about internal self-sufficiency; they are planning to stop exports. These are not the actions of parties comfortable with the way things are.

The greatest irony for 2022 is that in the most piously committed emission targeting country in the world, we are on the verge of one of the biggest oil runs we may have witnessed in decades. Canada’s oilsands are going to kick ass in 2022.

Continued retirement of nuclear generation facilities in the United States and abroad cannot be serviced by renewables alone which means that gas-fired generation will have to play a role. Or the lights go out. And coal! King Coal is back! At least for a year or two.

At the same time, localized shortages of LNG underscore that Canada’s massive LNG Canada project still makes sense even in a de-carbonizing world.

So, we see a continuation down the energy transition pathway – albeit through several detours and construction zones. Also, a raging bull market for natural gas, oil and Canadian Oil Sands and, more importantly, a reality check for all the end fossil fuels arm-chair quarterbacks who thought it was going to be as easy as a clap-on, clap-off light bulb.

For industry participants, it’s precisely this type of chaotic destruction that creates opportunity. The smart players will straddle both worlds and become diversified “energy” companies and will secure the backing of capital providers who recognize the opportunity, aren’t intimidated by divestment movements or ESG box-tickers and will ultimately help manage the transition more effectively and efficiently than governments ever could.

It’s a pretty broad theme. I believe the transition will happen. Still. But it’s a bumpy ride. And it has just gotten a lot more expensive to execute. Inflation. Interest rates. Cost of capital. These things matter.

Oh yeah, electric vehicles. 2022 will see the major automakers finally strike back at Tesla. Elon’s going to be going through some things.

Price of oil

Every year this is the flagship call of the Fearless Forecast. It is my futurist, TED talk moment. I stand in front of you, confident, even brash. Prognostication in hand, I explain why what I say is right. And then, it’s like a Jason Kenney COVID strategy – it starts to unravel even as I’m saying it. And after my mega-rant above, I clearly can’t take a COVID mulligan or make any excuses. I’m clearly… bullish!

So – my thoughts.

First off, I expect oil and gas demand to increase by about 2%-3%, to 102 mm bpd as economies continue to reopen. How this demand is met is the biggest question for prices. If it comes from OPEC+++++++, with Saudi Arabia managing the market, I don’t see a wave of supply. This puts a floor on prices.

Inventories are declining and depending on how quickly we get to my demand prediction, by mid year we could be hitting a wall as decline rates and lack of global investment in prior years bite the industry in the proverbial butt. Traditional suppliers will be unable to ramp up supply fast enough – Iran will likely still be under sanction and Venezuela is out. OPEC isn’t meeting quota, Mexico is pulling in its horns. The US is struggling to get dollars allocated from GameStop, Bitcoin and Tesla into LTO wells in the Permian. This ironically (or fortuitously) leaves Canada as a place that can actually provide a steady, low decline and predictable supply.

This is all of course bullish for prices.

In past years when I said bullish, I got too bullish. I think prices have room to run, but with a ceiling above which the thesis breaks down. It is incumbent on OPEC to manage this or it could get ugly.

My year end WTI price is $86.23 and my average price for the year is going to be $82.34. Look – there is a lot of money to be made for everyone at these prices. I can’t bring myself to $100 or higher. $90 maybe, but if we go to $100 in a hurry we end the year at $60, no one wants that.

If the LTO guys can avoid putting too much vodka in the punch bowl we should be good in this range.

Price of Natural Gas

Ah natural gas, I can’t quit you!

For too many years, natural gas has been disappointing me and pretty much all of Canada with lousy pricing for what seems like forever. Flashing great potential at times before collapsing back to “super-cheap alternate fuel – why don’t we use even more of it” status. And like any true forecaster for natural gas, we watch the storage reports with bated breath and hope for a polar vortex to descend on New England, spiking prices and proving our bullish forecasts right for yet another fleeting week before crashing back to earth with a heat wave in the Midwest.

Except here’s the deal. Last year the worm turned. Gas consumption in the US is way up. Exports of LNG are growing rapidly and exports to Mexico are also rising. Europe’s electricity crisis has exposed the soft underbelly of the energy transition, the need for gas-fired power generation, and lots of it.

The catalyst for gas is now right in front of us – LNG Canada, more export capacity out of the US, the completion of the coal to gas power conversion. We may be into a mini Golden Age for gas production in Canada (sorry, is that the kiss of death? I didn’t mean it.).

My year end price for natural gas (NYMEX) is going to be $4.23 and the average price will be $3.84, up from last year. AECO will again have a better year than I think many Canadian producers are used to, which, combined with oil sands prospects will generate sufficient royalties to eliminate Alberta’s deficit by 2023 and see Jason Kenney re-elected if he survives his leadership review this April. Which he will, by the slimmest of margins.

Production

For many producers in the Permian and continental United States, drilling will recover with prices over the course of the year, but it isn’t going to be dramatic as players watch prices, wait to see what the Biden administration will try roll out for emissions regulations and struggle to get increasingly expensive capital allocated to them.

To maintain production against its epic decline rates, the US LTO industry needs to drill and complete thousands of wells every year. This volume was barely met in 2021 and the production impact of a slower year is going to reverberate throughout 2022 regardless of any drilling activity over the course of the year.

Capital for new drilling programs is scarce and cost is rising. The monstrous DUC inventory has been mined and the dirty little secret of the DUC count is that probably a quarter of these were never going to completed anyway. Rig count will continue to grow with prices, but break evens are going to rise with drilling costs as inflation and supply chain issues continue to impact an industry that consumes a tremendous amount of raw material.

All of the preceding is a long-winded way of saying that we believe that US production will grow, but modestly, during the year. If we assume the year end production numbers of about 11.8 million bpd of production in the US is correct, we are going to pick 12.0 for year end.

In Canada, activity levels should over the course of the year more closely resemble what some are hoping they can call a “normal” year. Intensely active areas of conventional unconventional (tight oil, deep basin, condensate, liquids rich, natty) activity in places like the Duvernay/Montney/Viking and the Bakken but not much in between, at least for the first part of the year. Maybe some pick up in heavier areas as the year progresses. Rig count will also pick up in British Columbia as drilling to support LNG Canada picks up. Continued optimization and slow-footed brownfield expansion in the oilsands will continue, but not much more. Costs will rise due to inflationary pressures. Lack of manpower will hold back many programs and contribute to wage inflation.

While the year will be massively bullish for oilsands producers and investors, the market signals are not all in for any material expansion. We are thinking not much growth above replacement of natural declines, notwithstanding recent record production levels. We are encouraged by a capital budget for oilsands giant CNRL of $4.3 billion, an almost 10% increase over 2021 and expect others to follow suit. Still, even with that massive spend, production growth is modest.

OPEC production levels will depend on what happens with the re-upped OPEC/NOPEC agreement at the various jump-off points through the year. At current price levels, OPEC is in a goldilocks zone and will use its perceived market power as a regulator. If shale growth surprises to the upside, expect the Saudis to act to rein in prices. It’s a risky game but I would think OPEC/NOPEC output to rise about 800k to 1 million bpd over the year as the market strengthens

In the rest of the world, it’s a limited growth scenario. New projects in the North Sea will continue to ramp up and investments in Africa (Gabon) will come on-line. Latin America will be sold as a growth area – look for Brazil to disappoint because that is what they do – but material growth is, as always, a couple of years out.

The fact that global supply growth is not expected to come from the short cycle US shale sector should be concerning because it now starkly exposes the lack of investment in other regions and being such a capital dependent industry, production can turn negative as quickly as it ramps up. Inventories can come down very rapidly and we have seen over the last few years how difficult it is to reverse a trend once it starts. If as expected the globe recovers quickly from the pandemic induced consumption decline, and consumption snaps back above 100 million barrels of oil a day by year end a poorly managed supply expansion and resultant price spike could stick a pin in the economic recovery. We actually need production growth. Just not too much, so we can keep the party going.

Drilling Activity Levels

On the Canadian side, notwithstanding my bullish sentiment, this year is going to be a hard one to predict for drilling activity. But I am going to do my best.

There is always a lot of uncertainty in the Canadian market given our well-documented egress issues, pricing dilemmas, weather and purported federal government hostility to industry.

More importantly. as I have explained in prior years, given Canada’s production mix, the need to drill isn’t consistent across the basin. With only about 25% of Canadian production subject to higher decline rates, the incentive to drill isn’t always there because the pipes are full of heavy oil. Plus, we don’t have the intense drilling imperative that the US has, where more than half of their production has a 35% decline rate as well as lower production per well so they have to drill like lunatics just to stay in one place. It is easy to see the excuses Canadian oil and gas companies have for sitting on their hands and not spending until absolutely necessary – cheap bastards.

On the other hand, we Canadians are creatures of habit and it’s winter and in winter we drill.

With all that in mind and taking into account OPEC and LTO as well as high natural gas prices, plus no accountability whatsoever, I will confidently predict that activity in Western Canada will be … about 10% ahead of 2021.

Expect to see 6,000 (+/- 300) combined oil and gas wells drilled in 2022. Capex should be up 10%, with an upside for 20%.

It’s already been discussed elsewhere but drilling activity and capex in the US is expected to be up 10%. It’s going to be a different year for American drillers – still activity, but the ongoing commitment to capital discipline will make things seem tight.

M&A Activity

M&A in the oil patch, at least the North American upstream side, managed to register a robust 2021. There were certainly signature deals on both sides of the border and not all of them involved bankrupt producers. I expect this trend to continue through 2022 as property consolidation, non-core asset sales and private equity investment all pick up as the industry adjusts, yet again, to a new normal. Expect the M&A activity to be broadly based – upstream, downstream, oil, gas, services and everything in between.

On the Canadian side, M&A activity should pick up as portfolio rotation out of inflation sensitive sectors brings American and international investors back to Canada and our absurdly high Free Cash Flow yields start to attract interest.

Albeit more expensive due to rising interest rates, capital should become easier to access as the year progresses and the prospects for the industry firm up. There are many funds and investors currently playing the ESG game and shunning traditional oil and gas. These types of developments are to be expected in an energy transition world but don’t expect to it to become all-consuming. There is still plenty of capital that gets it. And the sector rotation into commodities is still early-stage.

As in prior years, there are a number of Canadian companies that are historically undervalued cash cows and in a post-COVID world where everyone is searching for an inflation hedge, these companies will attract interest.

I know I say this every year, but this time I mean it – expect a prominent Canadian name or two to find themselves with new foreign owners as the year progresses. Construction on LNG Canada should also lead to M&A activity amongst the gas-weighted companies as they seek to fill the gas supply not already developed by the project proponents. So, American or foreign interest coming back into Canada – crazy I know, but I did say it was a “fearless” forecast.

Also, with all this cash, still low valuations and nowhere to put it, I believe at least one Canadian name is due to take itself private. My thoroughly scientific Twitter poll had 190 votes and 41% said Whitecap and 32% said Baytex. Grant, if you need an advisor, call me.

On the services side, we are very bullish on energy infrastructure and related industries and see that as an area where Canada will see a fair amount of activity. Mid and downstream oriented companies will continue to be of interest to strategic consolidators and private equity.

On the upstream drilling side, increased activity means ancillary service providers such as safety and testing companies will also attract interest in addition to traditional drill-bit focussed companies.

In addition, this is an evergreen paragraph, but Canadian companies are well-known for their technology and solutions-based approaches to innovation and there is a well-worn path of US PE and strategics coming north of the border to snap up cheaper Canadian tech. With an uncertain market in the United States, look for these companies to draw interest, particularly ones that have technologies that address emissions or can reduce costs in an inflationary, supply-chain challenged world.

The following evergreen statement holds true:

Canada is a currency advantaged, undervalued and stable market for consolidators tired of the madness in other markets. Global recovery and growth indicates a commodity super cycle, likely the last big run of my career. Show me the money people!

Canadian Dollar

The Canadian dollar should see some relative stability this year with commodity prices, but there is no real catalyst to send it upwards aside from timing differentials with the United States in the economic cycle. Every country around the world has blown its brains out with debt the last year to spend out of the pandemic so on a relative basis, where does the change come from? Inflation in Canada is running a bit behind the US which means the Bank of Canada won’t be as aggressive as the US Fed to raise rates, but they will still follow suit. Housing and debt is a drag on the currency but oil and gas keeps it propped up. I fully expect the Canadian dollar to close the year around where we are, at $0.82.

Interest Rates and Inflation

Inflation is a major global issue no matter how many people tell you it is transitory. Transitory is a stupid term. Rising prices beget rising prices. Producer Price Inflation (PPI) in the US is running about 5% higher than the CPI which is running at 7.5%. The PPI is a leading indicator to PPI. We have months to go before things settle down.

The last few times inflation in the US ran hotter than 5% for an extended period, it was quickly followed by a recession. Energy prices have risen by close to 50% and lack of investment suggests this is a new plateau. Housing prices – both prices and rent – are at record levels and rising – not only in Canada but around the US and the rest of the world. Asset bubbles in tech, crypto, NFT, art and other markets are peaking by any objective measure and some have begun to deflate in the face of inflation and interest rate rises. Wage growth is running rampant everywhere except Canada (yay for us?). Supply chain disruptions continue, some are permanent. The renewables transition is sucking up every spare ingot of nickel, copper and other base metal around, raising prices for solar panels, wires for electrification and ultimately energy prices. Again.

These are not transitory signals. There is a red engine light is flashing on the dashboard. We’ve been ignoring it too long. I expect rates to increase by 150 basis points in the US and Canada this year. I wouldn’t be surprised to see the US start with a 50 bp increase as soon as this month.

Will it be a soft landing? Maybe. My opinion? Depends on energy. If we can keep the goldilocks pricing I am forecasting, yes. $100 oil for more than cup of coffee? It all starts to break down.

Infrastructure

Finally, right? I know in the media things look bleak, what with Trudeau and Biden, ESG and the energy transition, inflation and all that jazz, but it may surprise people outside of the energy sector that we are in the midst of an energy infrastructure supercycle in Canada. This should continue well into the mid-2020s. Here’s what I see in 2022:

- TransMountain Expansion crossing the midpoint with multiple spreads operating during the year in Alberta and BC

- Coastal Gas Link continuing notwithstanding current challenges

- NGTL Expansion well underway

- Continued Petchem investment

- Signature CCUS projects

- Renewables projects galore including utility scale solar, wind and storage projects including pump storage.

People are spending money. In Western Canada. Of all places! On something other than real estate.

Stock Picks

Last year was a disaster of sorts. I underperformed the index, and my renewables pick was almost exclusively to blame.

This year I am determined to hit it out of the park, and to use my main themes – energy security and inflation, to guide my picks.

True to my rules, I have to pick two Canadian E&P’s as well as two service-oriented companies and, finally, one non-Canadian producer and a service company.

Here goes nothing…

On the Canadian oil and gas E&P side, I am going to stick with my oilsands cash cow theme and grab some natty for fun. Both of these companies should benefit from the current environment and one in particular has been beaten down so hard, they need a hand up

Pick #1 is Suncor. Look, I know, it’s an awkward pick but I can’t pick CNRL two years in a row and I need the oilsands exposure. Suncor (SU) is CNRL’s awkward second cousin. They have had asset issues for years. The investment community universally slams them. They own PetroCanada which is like wearing a “I love Trudeau and the NEP” hair shirt. Twitter #EFT relentlessly mocks them. And this is what gives me hope. It is time for the deeply downtrodden to rise Phoenix-like from the depths and prove all the naysayers wrong.

Pick #2 is Encana. Yes I know. It’s actually called Otrivin. Or is it Omicron? Oh wait. I know, Ovintiv! Wait, aren’t they American? Well maybe. But they have a boatload of gassy property up in Canada and they are set to spend like Kardashians. I need a gas stock and I like their cash flow prospects, OK?

Now on to the Canadian service side…

Pick #3 … Altagas. Altagas is a Canadian based energy infrastructure company. They have super exciting things like storage terminals, gathering and processing facilities, pipelines, transmission, distribution and marketing assets. They aren’t the most exciting company out there, but at some point you need to stop living on the edge. All. The. Time.

Pick #4… PHX Energy Services. Formerly know as Phoenix Technology Income Fund. Why this one? Well I can’t say drilling activity is going to increase without positioning the portfolio to take advantage of it. So here we are. They provide drilling technology services to producers here in Canada, in the United States and in Russia. Their website says Albania as well and since that is such an energy hotbed what could go wrong? In all seriousness, a drilling technology company with growing revenues that operates internationally. And hasn’t had the Trican runup. Let’s see what happens.

Now to my US companies!

Pick #5 – This is usually a producer. Last year I took a downstream business and the refiner killed my returns. I may never forgive them for the disappointment they delivered. In my search for a US producer, I am of course fully committed to finding someone who has low debt and great prospects. Bit of a needle in a haystack hunt I know, but here’s what I’m going to do. I also like to pick stocks that have cool names and sometimes I get distracted like I’m researching holistic medical cures for COVID. Oh crap, what have I done, I’ve gone and picked Earthstone Energy. What a soothing name. Hmm, properties in the Midland and Eagleford area of Texas. Growth oriented? WTF? Did they not get the memo?

Pick #6 is on the service side and will also have an environmental/renewable flavor. The company is called SunPower Corp. They provide solar installation and service both in the US and globally. It’s a bit of a flyer, but they also have a financing company so they can technically approve each project that comes in, so revenues are completely within their control and, thus, infinite. In an inflationary, rising interest rate environment where renewable investment is likely to slow fairly dramatically, what could possibly go wrong.

That’s it!

Fearless? Sure. Crazy? No doubt. Food for thought? I hope so.

A few final predictions in the quickfire round…

Indictment – Two. One conviction. Election interference.

Super Bowl – Immunized!

Stanley Cup – Vegas Baby!

PM end of 2022 – Freeland

Calgary Event Centre – It’s a go. No Flames involvement

Portfolio performance – up 31.5%

Ontario Election: Toss up. Liberals

Quebec Election: The most racist one.

My time here is done.

Invest wisely.